Pursuing financial careers in developing nations like Mali often presents unique challenges due to limited resources, access to quality education, and economic constraints. For students, navigating career choices in finance demands strong foundational skills in financial literacy, strategic career planning, and innovative self-learning techniques. This article explores how K12 education systems can bridge these gaps and provide students with the tools to succeed in this competitive field.

Challenges in Building Financial Careers in Developing Nations

Developing nations often face systemic barriers that hinder the pursuit of financial careers. For example, countries like Mali struggle with educational infrastructure deficits, making it difficult for students to gain exposure to advanced financial concepts. Additionally, high costs associated with international education and finance-related degrees can deter students from considering higher education abroad.

Moreover, the lack of localized financial career opportunities exacerbates the problem. Many students are forced to either leave their home countries for better prospects or rely heavily on self-learning resources to enhance their knowledge. As a result, preparing students early in their educational journey becomes crucial for addressing these challenges.

The Role of K12 Education in Career Preparation

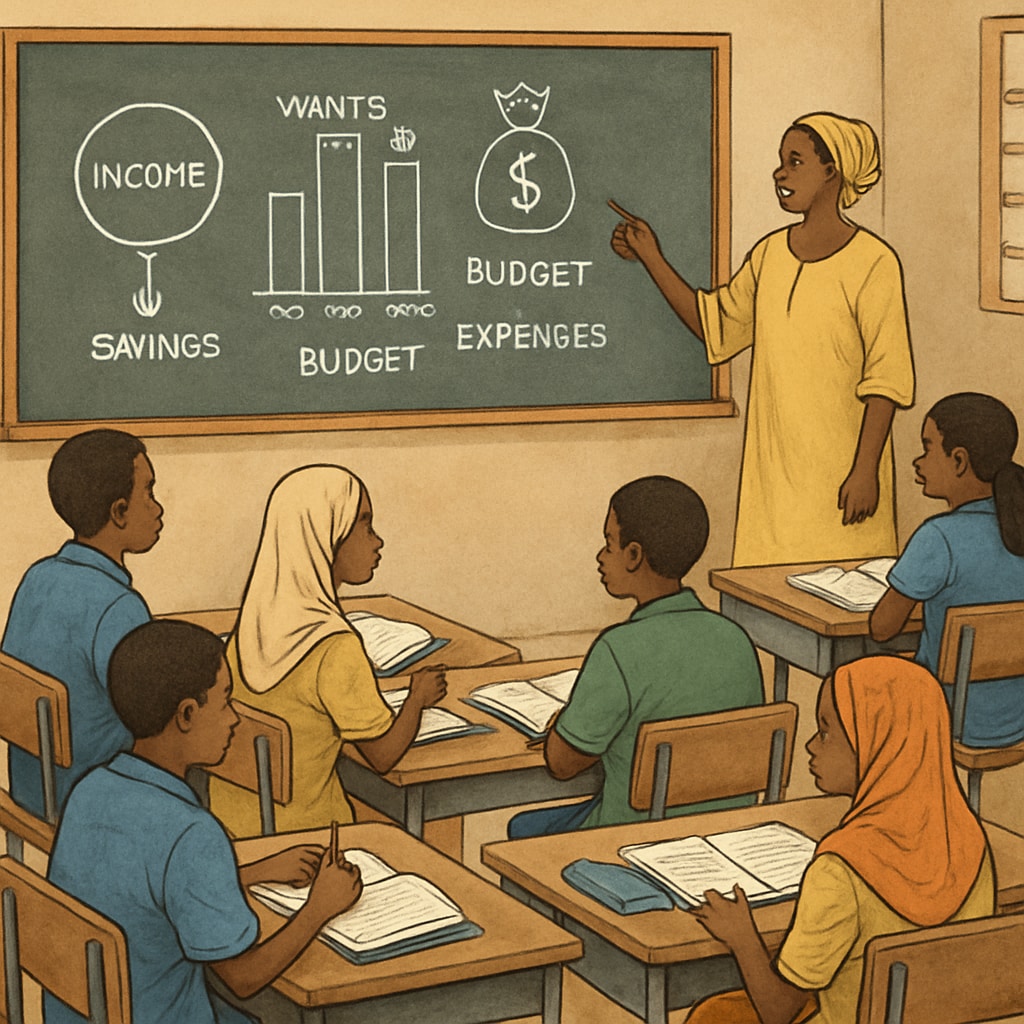

K12 education serves as a critical phase where students can develop essential skills for their future careers. Integrating financial literacy into the curriculum allows students to understand basic financial principles, such as budgeting, investing, and managing debt. These skills not only prepare them for personal financial management but also provide a foundation for professional roles in finance.

Career guidance programs at the K12 level can help students explore different pathways in finance, including banking, investment analysis, and accounting. By offering workshops, mentorships, and simulations, schools can empower students to make informed career choices. In developing nations, partnerships with local and international organizations can further enhance the resources available for career planning.

Self-Learning as a Key Strategy

Given the scarcity of quality financial education resources in developing nations, self-learning has emerged as a practical alternative. Online platforms such as Khan Academy and Coursera provide free or affordable courses on financial topics, enabling students to learn independently. For example, a student in Mali might use these resources to study financial analysis or stock market dynamics, supplementing the gaps in their formal education.

Additionally, fostering a culture of self-learning can encourage students to develop resilience and adaptability—qualities highly valued in the financial sector. Educators can support this by introducing students to self-directed learning techniques and encouraging them to explore available platforms.

Higher Education and International Opportunities

While self-learning provides a strong foundation, pursuing higher education remains a critical step for many students aiming for advanced financial careers. Scholarships and exchange programs can open doors to international universities where students can gain exposure to cutting-edge financial practices. However, the costs and requirements of studying abroad often limit access for students from developing nations.

To address this, governments and NGOs can collaborate to create financial aid programs specifically targeted at students from underprivileged backgrounds. In Mali, initiatives like these could dramatically increase the number of students entering the global financial workforce, ultimately benefiting the nation’s economy.

Conclusion: Empowering the Next Generation

Preparing students in developing nations like Mali for financial careers requires a multi-faceted approach, beginning with robust K12 education systems that emphasize financial literacy and career planning. Coupled with self-learning opportunities and international education pathways, these efforts can cultivate a generation of skilled financial professionals capable of driving economic growth locally and globally.

By investing in early education and creating accessible learning resources, developing nations can equip their students with the tools to overcome barriers and excel in the financial sector. As a result, they not only empower their youth but also contribute to the global economy with home-grown talent.

Readability guidance: This article uses concise paragraphs, clear subheadings, and lists to summarize key points. Active voice is prioritized, with limited passive constructions. Additionally, transitional phrases ensure smooth flow between ideas.