Combining business analytics with a minor in finance creates a powerful foundation for high-paying and balanced careers. In today’s data-driven world, professionals equipped with skills in both analytics and financial management are highly sought after. This dual expertise not only enhances decision-making capabilities but also ensures long-term career growth and flexibility. In this article, we’ll explore the career trajectories for individuals with this hybrid background, discuss strategies for achieving work-life balance, and provide actionable steps to progress from entry-level positions to executive roles.

Why Business Analytics and Finance Create a Winning Combination

Business analytics focuses on interpreting data to make informed decisions, while finance provides the monetary framework to evaluate these decisions. Together, these fields form a symbiotic relationship that is ideal for professionals working in industries like consulting, investment banking, fintech, and corporate management.

- High Demand: Companies increasingly rely on data analysts who understand financial implications, making hybrid professionals indispensable.

- Competitive Salaries: According to U.S. Bureau of Labor Statistics, roles like financial analysts and data scientists rank among the top-paying professions in the market.

- Global Opportunities: The hybrid skill set opens doors to work internationally, from Wall Street to global consulting firms.

For example, a business analyst with financial knowledge can provide insights into investment risks or cost optimization strategies, creating value that traditional analysts may miss.

Strategies for Career Development in Business Analytics and Finance

Achieving success in this hybrid profession requires thoughtful planning and continuous learning. Here is a step-by-step strategy:

- Start with Education: Pursue a degree in business analytics and add finance as a minor or certification.

- Build Foundational Skills: Learn tools like SQL, Python, and financial modeling software such as Excel or Tableau.

- Gain Industry Experience: Internships in consulting firms, banks, or tech companies are invaluable.

- Network Strategically: Attend industry conferences and connect with professionals on LinkedIn.

- Advance with Upskilling: Obtain certifications like CFA (Chartered Financial Analyst) or specialized data analytics credentials.

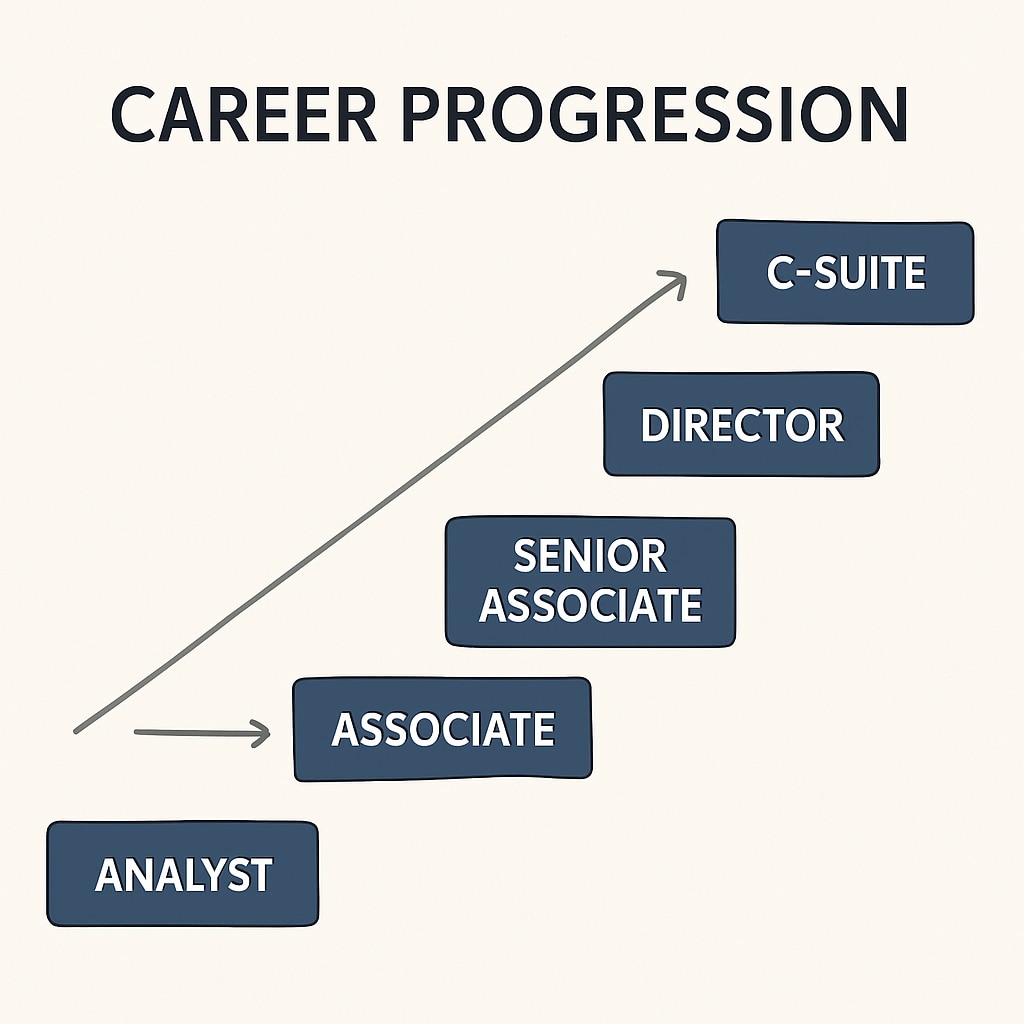

As a result, professionals can transition from entry-level roles to higher positions such as financial data analysts, strategy consultants, or even Chief Analytics Officers (CAOs).

Maintaining Work-Life Balance in High-Pressure Careers

While the rewards of pursuing analytics and finance are significant, these fields can also be demanding. Here are some tips to achieve balance:

- Set Boundaries: Define clear working hours to avoid burnout.

- Prioritize Health: Incorporate physical and mental wellness routines into your daily schedule.

- Automate Tasks: Use software tools to streamline repetitive tasks and save time.

- Delegate: As you climb the career ladder, delegate responsibilities to focus on high-impact areas.

Finding balance is key to sustaining long-term success in analytics and finance. For example, executives often use time-blocking techniques to allocate hours for strategic thinking, team management, and personal activities.

Conclusion: A Pathway to Success

Business analytics combined with finance offers an unparalleled career trajectory. By mastering these disciplines, professionals can unlock lucrative opportunities, contribute meaningfully to organizational growth, and build a fulfilling career. Whether you’re just starting out or aiming for executive roles, this hybrid skill set provides the tools to thrive in a competitive, data-driven world while maintaining work-life balance.

For more insights into business analytics and finance, visit reputable resources like Data Analysis on Wikipedia or Finance Overview on Britannica.