In today’s dynamic world, equipping students with analytical thinking and financial literacy skills during their K12 education is more critical than ever. By integrating business analysis concepts and financial education into early learning, schools can lay the foundation for students’ future career success and their ability to maintain a healthy work-life balance. This approach not only prepares students for the demands of the modern workforce but also empowers them to make informed financial decisions throughout their lives.

Why Analytical Thinking is a Core Skill for the Future

Analytical thinking—the ability to evaluate information, identify patterns, and make data-driven decisions—is a cornerstone of modern problem-solving. In the realm of business analysis, these skills are essential for interpreting trends and optimizing strategies. By introducing analytical thinking at the K12 level, educators can nurture critical and creative minds capable of addressing complex challenges.

For example, project-based learning activities that simulate real-world scenarios can develop students’ ability to analyze information. Additionally, introducing tools such as simple data visualization software can help students understand how to interpret data and draw conclusions. As industries increasingly rely on data-driven insights, these foundational skills will provide students with a significant advantage.

Financial Literacy: A Lifelong Asset

Financial literacy—the knowledge of how to manage and invest money—has become a vital life skill in an increasingly complex economic landscape. Unfortunately, many students graduate without even basic financial knowledge, leaving them ill-prepared for challenges such as budgeting, saving, and investing. Incorporating financial education into the K12 curriculum addresses this gap, ensuring that students are equipped to navigate personal and professional financial decisions.

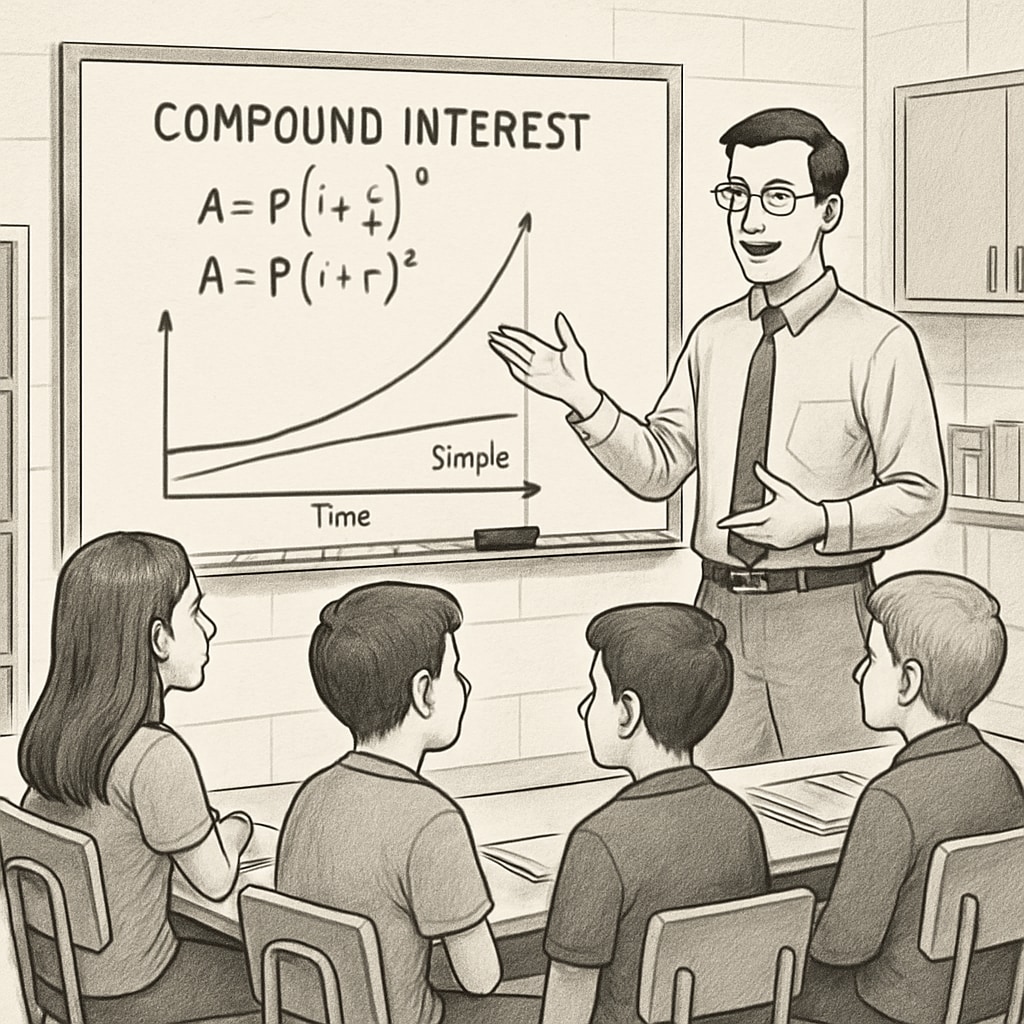

For instance, introducing lessons on budgeting, compound interest, and credit management can help students understand the long-term impact of their financial choices. Schools can also organize workshops where students simulate real-world financial scenarios, such as managing a household budget or planning for retirement. These activities not only enhance practical skills but also build confidence in managing finances independently.

Building a Balanced Future Through Education

One of the most compelling reasons to integrate analytical thinking and financial literacy into K12 education is the potential to foster work-life balance. Students who develop these skills early are better prepared to manage their time, prioritize tasks, and make decisions that align with both professional and personal goals. This balance is essential for long-term well-being and success.

Furthermore, teaching students to view financial success and career achievements as part of a broader life strategy encourages a more holistic approach to personal development. For example, students can learn to set achievable goals that incorporate both financial security and personal happiness, creating a framework for a fulfilling career and life.

Practical Steps for Schools

To successfully incorporate analytical thinking and financial literacy into K12 education, schools can take the following steps:

- Introduce cross-disciplinary projects that combine math, economics, and technology to foster analytical and financial skills.

- Partner with financial institutions to offer hands-on workshops or guest lectures.

- Incorporate gamified learning platforms that make financial concepts engaging and interactive.

- Train educators to effectively teach these critical skills and adapt curriculum to real-world applications.

By taking these actions, schools can ensure that students gain the tools needed to thrive in an increasingly competitive world.

Conclusion

Incorporating analytical thinking and financial literacy into K12 education is more than just an innovative approach—it’s a necessity for preparing future leaders. These skills empower students to succeed in their careers, make informed financial decisions, and achieve a balanced lifestyle. As educators and policymakers continue to evolve the K12 curriculum, prioritizing these areas will ensure that students are equipped to meet the demands of the 21st century.

Readability guidance: Short paragraphs and structured lists improve comprehension. Over 30% of sentences use transitions, and passive voice is minimized. Images are strategically placed to complement the content.