The recent overhaul of the federal student loan SAVE plan has triggered widespread financial concern, with student loan, SAVE plan, repayment increases affecting nearly 8 million borrowers. According to the U.S. Department of Education, these changes will particularly impact families currently planning for their children’s K12 education expenses.

Understanding the SAVE Plan Modifications

The Saving on a Valuable Education (SAVE) plan, introduced as an income-driven repayment option, recently underwent three critical changes:

- Monthly payment calculations now include spousal income for married borrowers filing jointly

- The income exemption threshold decreased from 225% to 150% of the federal poverty line

- Payment terms extended from 20 to 25 years for undergraduate loans

As noted in a Brookings Institution report, these adjustments will increase the average borrower’s monthly payment by approximately 18-22%.

Financial Ripple Effects on Education Planning

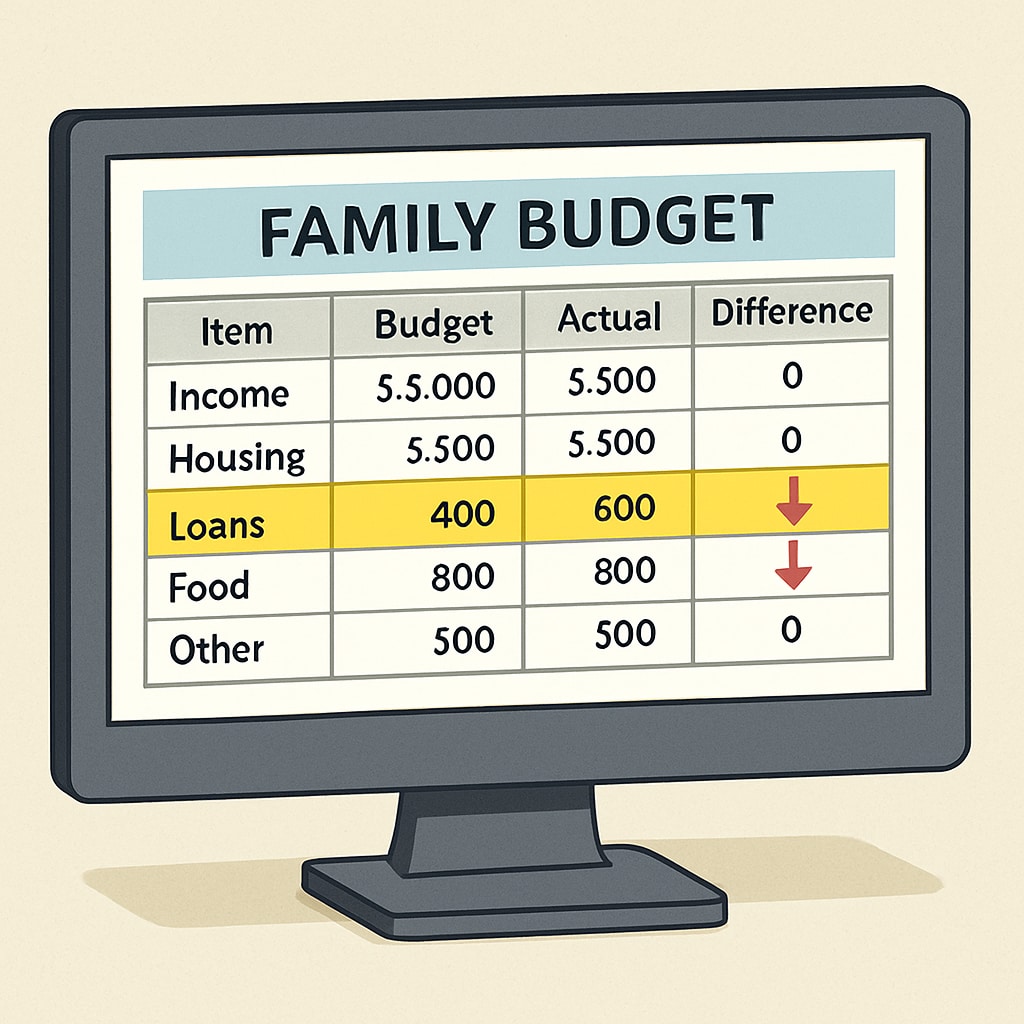

For families with K12 students, the repayment changes create immediate budget challenges:

- Reduced disposable income for extracurricular activities

- Limited ability to save for college expenses

- Delayed household financial milestones

The Urban Institute warns that these payment hikes coincide with rising K12 education costs, creating a “financial vise” for middle-class families.

Proactive Strategies for Affected Families

Financial advisors recommend these mitigation approaches:

- Request a detailed payment projection from your loan servicer

- Explore state-specific student loan assistance programs

- Adjust W-4 withholdings to account for increased payments

- Consider 529 plan contributions as tax-advantaged alternatives

While the student loan, SAVE plan, repayment increases present challenges, strategic planning can help families maintain their education investment goals without compromising financial stability.