The proposal to link child tax credits with student academic performance represents a groundbreaking approach to enhancing parental responsibility in education. By creating financial incentives tied to educational outcomes, this policy could transform how families engage with their children’s learning journey.

The Rationale Behind Performance-Based Tax Credits

This innovative approach addresses three critical challenges in modern education:

- The growing achievement gap between socioeconomic groups

- Declining parental involvement in academic monitoring

- Limited financial resources for educational support programs

Research from the Brookings Institution shows that parental engagement significantly impacts student success, particularly in elementary and middle school years.

Implementation Framework for Academic Incentives

Several models could make this policy operational:

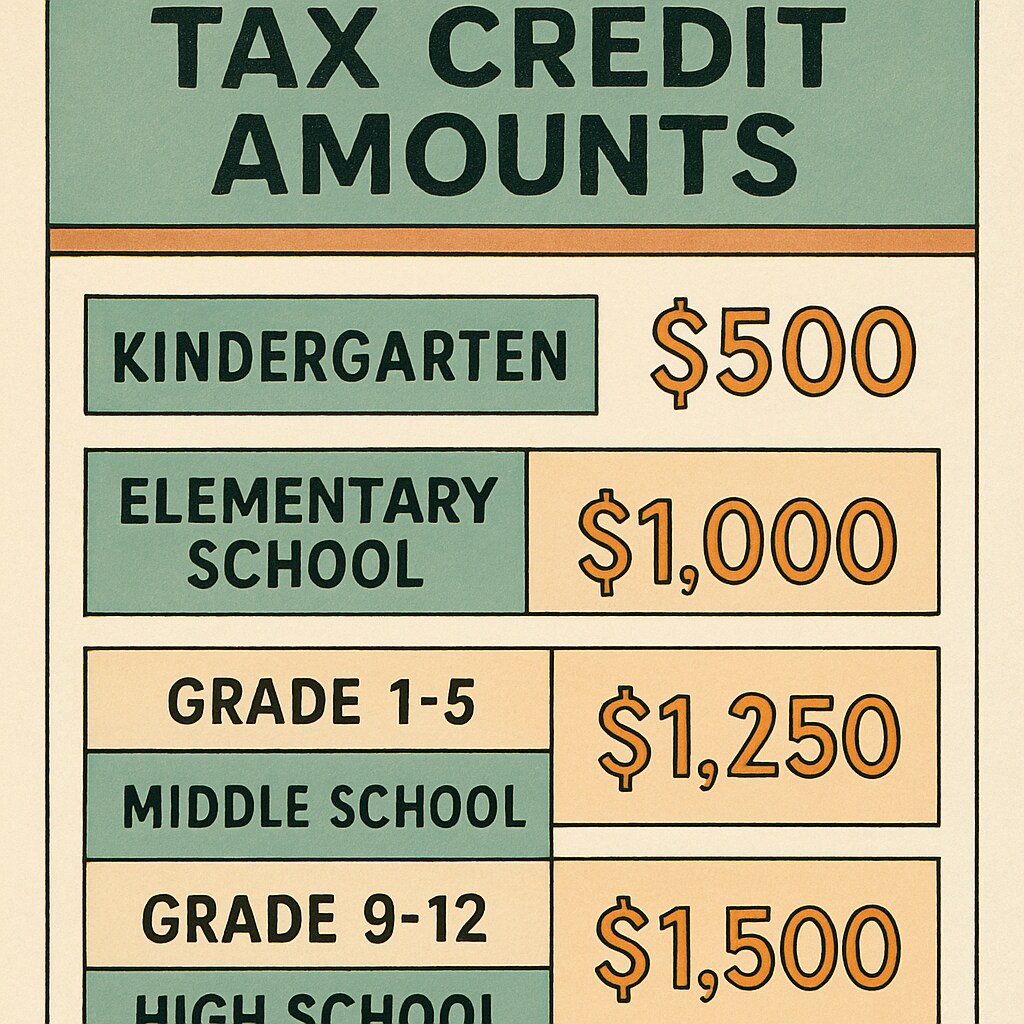

- Grade-based tiered credits (higher credits for better grades)

- Attendance-linked bonuses for perfect school attendance

- Standardized test score improvement rewards

The National Center for Education Statistics provides valuable data that could help design equitable measurement systems.

Addressing Potential Challenges

While promising, this approach requires careful consideration of several factors:

- Avoiding unintended consequences for students with learning disabilities

- Preventing excessive pressure on young learners

- Ensuring fair evaluation across different school districts

Readability guidance: The policy’s success depends on balancing incentives with educational best practices. Transitional phrases like “however” and “therefore” help navigate complex policy discussions while maintaining clarity.