The federal student loan SAVE plan changes have brought about a situation of student loans, SAVE plan, and repayment increases that is causing quite a stir. Nearly 8 million borrowers are now facing a significant hike in their monthly repayment amounts. This has particularly harsh implications for those within the K12 education system, including teachers and student families.

The SAVE Plan Shift

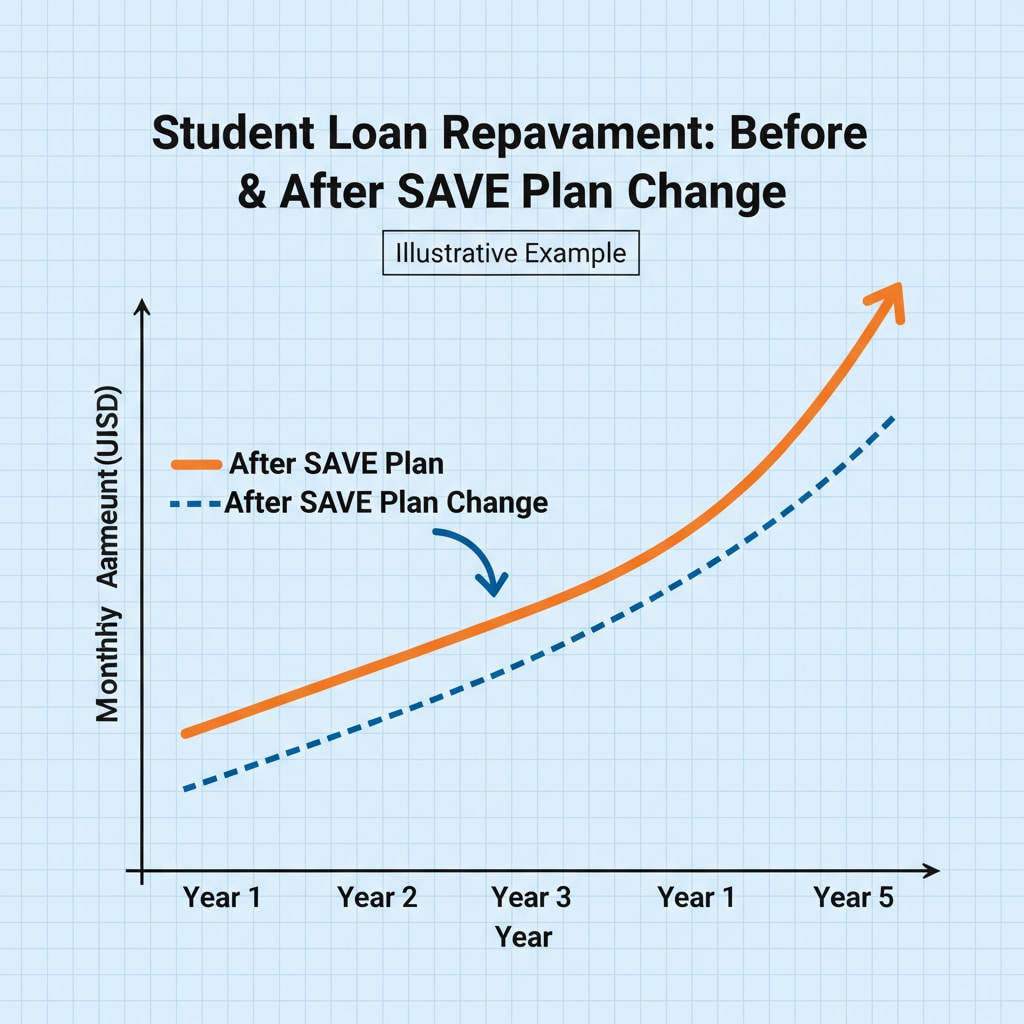

The SAVE (Savings on a Valuable Education) plan was initially designed to provide relief to student loan borrowers. However, the recent changes have taken an unexpected turn. These modifications have been a shock to many, as they were not widely anticipated. The plan’s new terms are now requiring borrowers to pay more each month. For example, according to Consumer Financial Protection Bureau, the recalculation of repayment amounts under the new SAVE plan has led to an average increase in monthly payments for a large portion of borrowers.

Impact on K12 Teachers

K12 teachers often have a passion for educating the next generation, but they are not immune to financial pressures. With the SAVE plan changes and subsequent repayment increases, many are feeling the pinch. Teachers, who typically don’t have extremely high salaries to begin with, now have to allocate more of their income towards student loan repayments. This could lead to a decrease in their disposable income, affecting their quality of life. As a result, some teachers may even consider leaving the profession in search of better – paying jobs to cope with the financial burden. According to National Education Association, job satisfaction among teachers is already a concern, and these repayment increases could exacerbate the situation.

Consequences for Student Families

Student families are also caught in the crossfire of these SAVE plan changes. Parents who have taken out loans to support their children’s education are now seeing their monthly bills rise. This can put a strain on family budgets, potentially affecting other aspects of the family’s financial stability, such as saving for college in the future or providing for basic needs. In addition, students may feel the pressure as they see their parents struggle with the increased repayment amounts, which could impact their educational experience and mental well – being.

In conclusion, the changes to the student loan SAVE plan and the resulting repayment increases are creating a challenging situation for K12 teachers and student families. It remains to be seen how the education ecosystem in the US will adapt to these new financial realities. The hope is that policymakers will take steps to address these issues and provide some much – needed relief. Readability guidance: This article uses short paragraphs to present information clearly. Each section under the H2 headings provides key points. The use of external links adds credibility, and transition words like ‘however’, ‘for example’, and ‘as a result’ help with the flow.