The sudden alterations to the SAVE plan for student loans have brought about a distressing situation where borrowers are grappling with a significant increase in their monthly repayments. This has hit close to home for K12 educators, who are now facing a financial storm that could undermine their stability.

The SAVE Plan Shift

The SAVE (Savings on a Valuable Education) plan was initially designed to provide relief to borrowers. However, the recent federal government changes have had an unexpected and negative impact. According to Consumer Financial Protection Bureau, these changes are affecting nearly 8 million individuals. For K12 educators, who often have relatively modest incomes, this is a heavy blow.

Impact on K12 Educators

K12 educators play a crucial role in shaping young minds. But now, with the increased student loan repayments, they are under financial stress. Many are forced to cut back on other essential expenses. Some may even have to reconsider their career choices. As per National Center for Education Statistics, the financial well-being of educators is directly related to their job satisfaction and retention in the field.

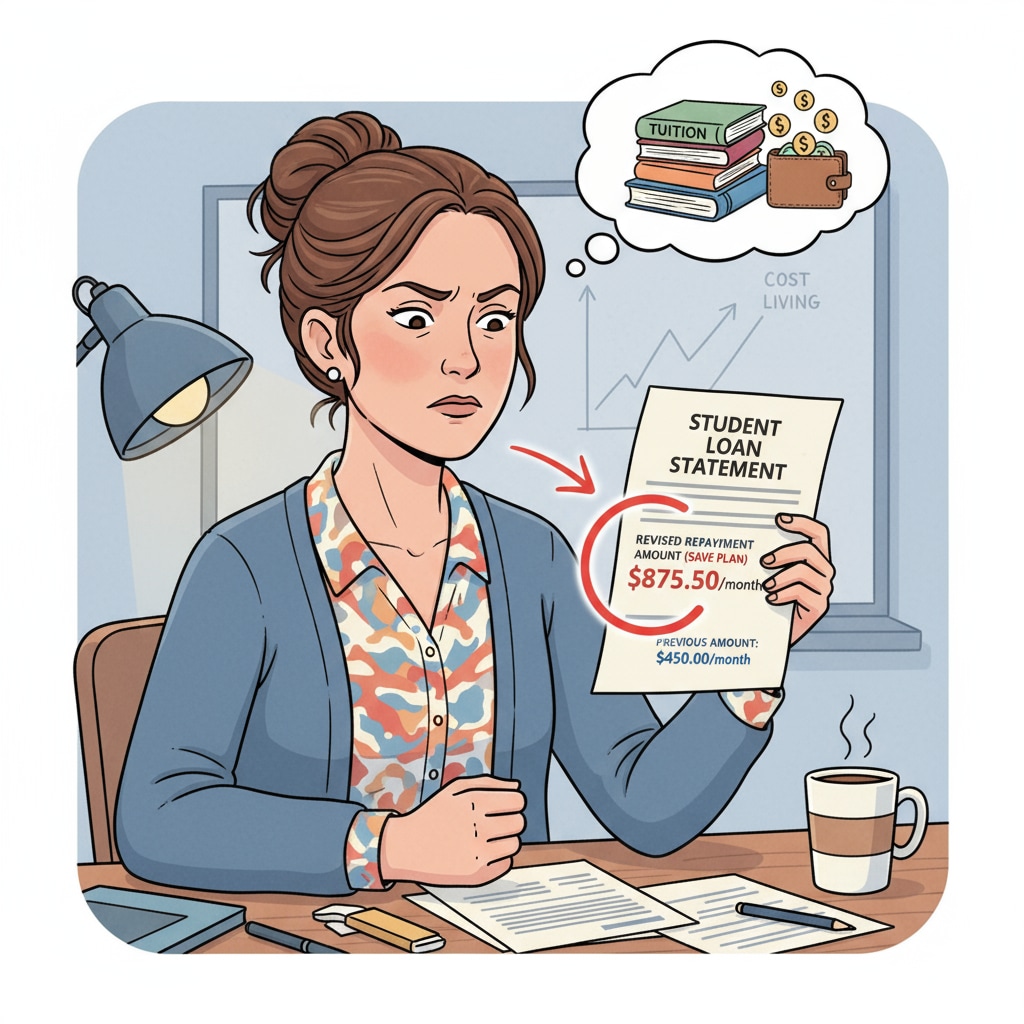

For instance, an elementary school teacher who was previously managing their finances comfortably is now struggling to make ends meet. The increased repayment amount has eaten into their budget for groceries, housing, and other necessities.

Readability guidance: We’ve used short paragraphs to clearly convey the key points. The lists and external links provide reliable information. Transition words like ‘however’ and ‘for instance’ help in smooth flow.