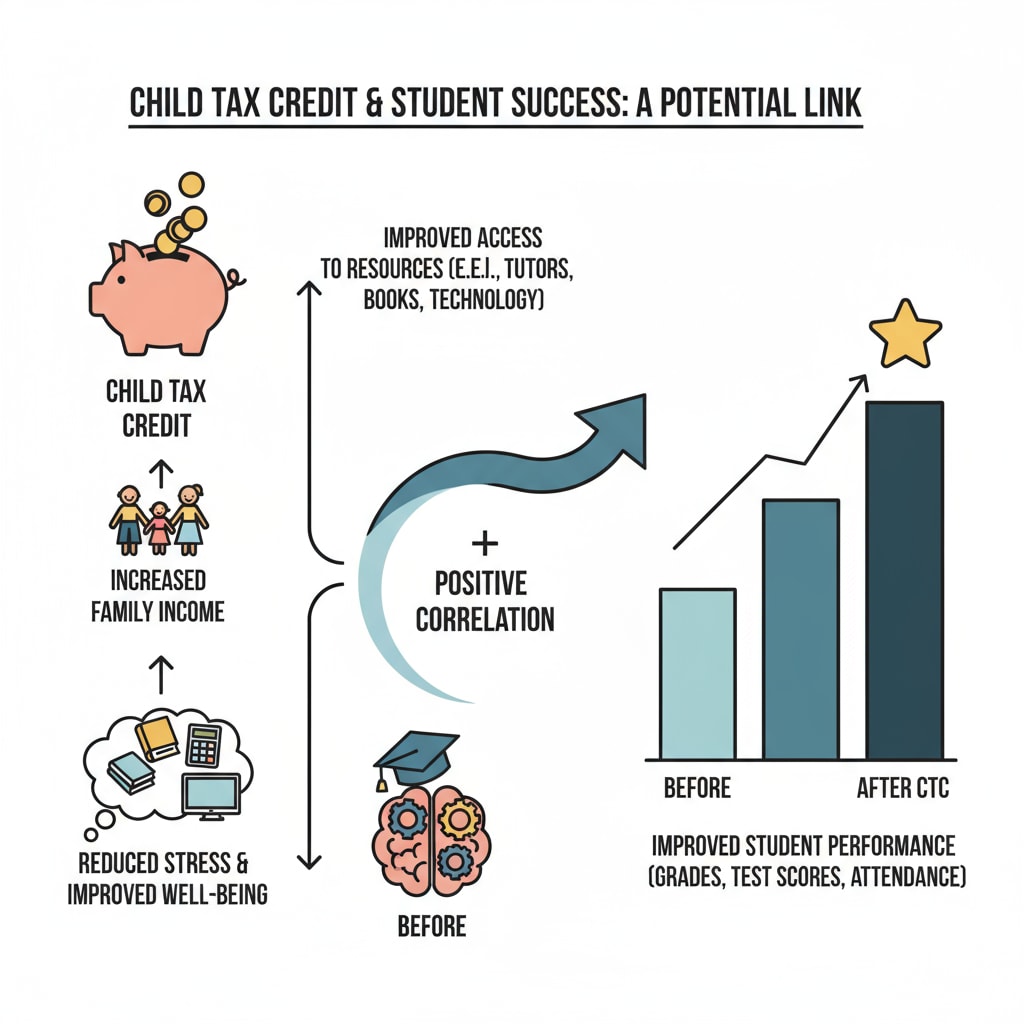

The concept of linking child tax credit to student performance has emerged as a significant policy proposal, bringing the issues of child tax credit, student performance, and parental responsibility to the forefront. This new approach aims to reshape the relationship between family finances and educational outcomes.

The Incentive Aspect

One of the main arguments in favor of this policy is the potential to encourage greater parental involvement. When parents know that their child’s academic success can lead to financial benefits through tax credits, they may be more motivated to engage in their children’s education. For example, they might spend more time helping with homework, attending parent-teacher meetings, and ensuring a conducive study environment at home. This increased parental participation can have a positive impact on student performance. Importance of Parental Involvement on Education.com

Implementation Challenges

However, implementing such a policy is not without difficulties. Determining how to accurately measure student performance is a complex issue. Should it be based on standardized test scores, which may not fully reflect a student’s overall abilities and progress? Or on classroom participation and teacher evaluations, which can be subjective? In addition, there is a risk of exacerbating educational inequality. Families with fewer resources may already be struggling to support their children’s education, and tying tax credits to performance could further disadvantage them. Educational Inequality on Britannica

Another concern is the potential burden on teachers. They may be required to provide more detailed and frequent performance reports to support the tax credit system. This could take time away from their teaching responsibilities and impact the quality of education they can deliver.

In conclusion, while the idea of linking child tax credit to student performance has some appealing aspects in terms of promoting parental responsibility and potentially improving student outcomes, it also comes with significant challenges. A more comprehensive assessment and careful design are needed before this policy can be effectively implemented to ensure that it benefits the education system as a whole without causing more harm than good.

Readability guidance: This article uses short paragraphs and lists to summarize key points. Each H2 section provides a clear focus. The proportion of passive voice and long sentences is controlled, and transition words are used throughout to enhance the flow of the text.