As the cost of tuition continues to soar, many students find themselves grappling with financial hurdles that threaten their academic dreams. Platforms like GoFundMe have emerged as unlikely lifelines for those striving to cover tuition expenses, particularly when aspiring to competitive programs such as medical school. This growing trend underscores the urgent need for reform in the U.S. education funding system, which fails to adequately support students transitioning from K-12 education to higher education.

The Financial Gap Between K-12 and Higher Education

While the K-12 education system in the United States benefits from substantial public funding, the transition to higher education often presents a stark financial reality for students. Public high schools are free for all, and many states offer initiatives such as subsidized lunches, extracurricular programs, and college-preparatory support. However, these benefits vanish when students enter college, leaving families to shoulder the burden of skyrocketing tuition costs and ancillary fees, such as textbooks and housing.

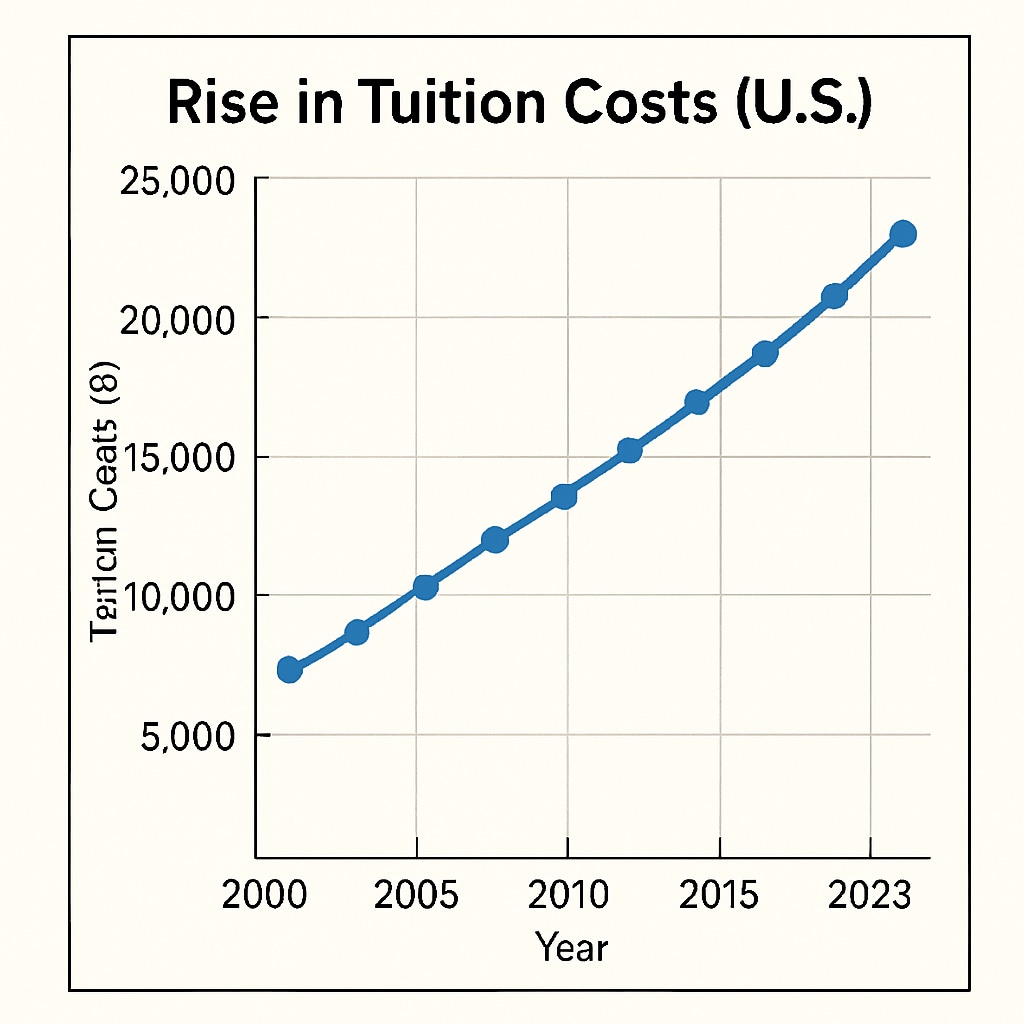

For example, the average cost of tuition for a four-year public university in the U.S. is approximately $10,000 per year for in-state students, while private institutions can charge upwards of $40,000 annually. This financial leap often catches students off guard, especially those from low-income households who may have relied heavily on K-12 subsidies.

Turning to Crowdfunding: The GoFundMe Phenomenon

Unable to secure sufficient scholarships or financial aid, students are increasingly turning to crowdfunding platforms like GoFundMe to finance their education. These platforms offer a way for individuals to share their stories and solicit donations from friends, family, and even strangers. Crowdfunding campaigns for tuition have become particularly prevalent among students in their final semester of college, who risk not graduating due to unpaid bills.

One notable example is a student aspiring to apply to medical school. After exhausting traditional financial aid options, they launched a GoFundMe campaign to cover their final semester of tuition. By sharing their story—detailing their academic achievements, career aspirations, and challenges—they were able to raise enough money to graduate and proceed with their medical school applications.

While crowdfunding has proven effective for some, it is not a long-term solution. It places the burden of financing education on individual networks rather than addressing systemic issues. Moreover, students who rely on crowdfunding may face stigma or emotional strain from publicly sharing their financial difficulties.

The Impact on Medical School Applications

For students applying to medical school, the financial strain can be especially daunting. Medical school requires a significant investment—not just in tuition, but also in application fees, entrance exams (such as the MCAT), and interview expenses. Students with outstanding undergraduate debt may find it even harder to commit to this rigorous and costly career path.

According to the Association of American Medical Colleges (AAMC), the average medical school graduate owes approximately $200,000 in student loan debt. This staggering figure discourages many talented individuals from pursuing medicine, particularly those from disadvantaged backgrounds. Crowdfunding may offer temporary relief, but systemic changes are needed to ensure equitable access to medical education.

Solutions: Preparing Students for Financial Independence

Addressing the financial challenges of higher education requires a multifaceted approach:

- Enhanced Financial Literacy Programs: Incorporating financial planning into K-12 curricula can help students better understand the costs associated with college and how to prepare for them.

- Increased Access to Scholarships: Expanding scholarship opportunities, particularly for underrepresented groups, can reduce reliance on loans and crowdfunding.

- Policy Reform: Advocating for reduced tuition costs or expanded government subsidies for higher education can alleviate financial pressure on families.

- Community Support: Encouraging local organizations to establish grant programs for students pursuing high-demand careers, such as medicine, can provide targeted assistance.

By implementing these solutions, the U.S. education system can better prepare students for the financial realities of higher education and ensure that talented individuals are not deterred from pursuing their dreams due to cost.

In conclusion, while platforms like GoFundMe have provided temporary relief for students struggling with tuition costs, they highlight deeper systemic issues within the U.S. education funding system. To truly support students—whether they aspire to medical school or other professional fields—policymakers, educators, and communities must work together to bridge the financial gap between K-12 and higher education. Only then can we ensure that every student has the opportunity to achieve their full potential.