For many college students in the United States, the dream of higher education often collides with the harsh reality of financial strain. Despite resources like FAFSA (Free Application for Federal Student Aid) and scholarships, the rising cost of tuition leaves countless students scrambling to make ends meet. Recently, a college senior preparing for medical school applications turned to a crowdfunding platform to raise funds for their final semester, shedding light on the growing financial pressures within the education system.

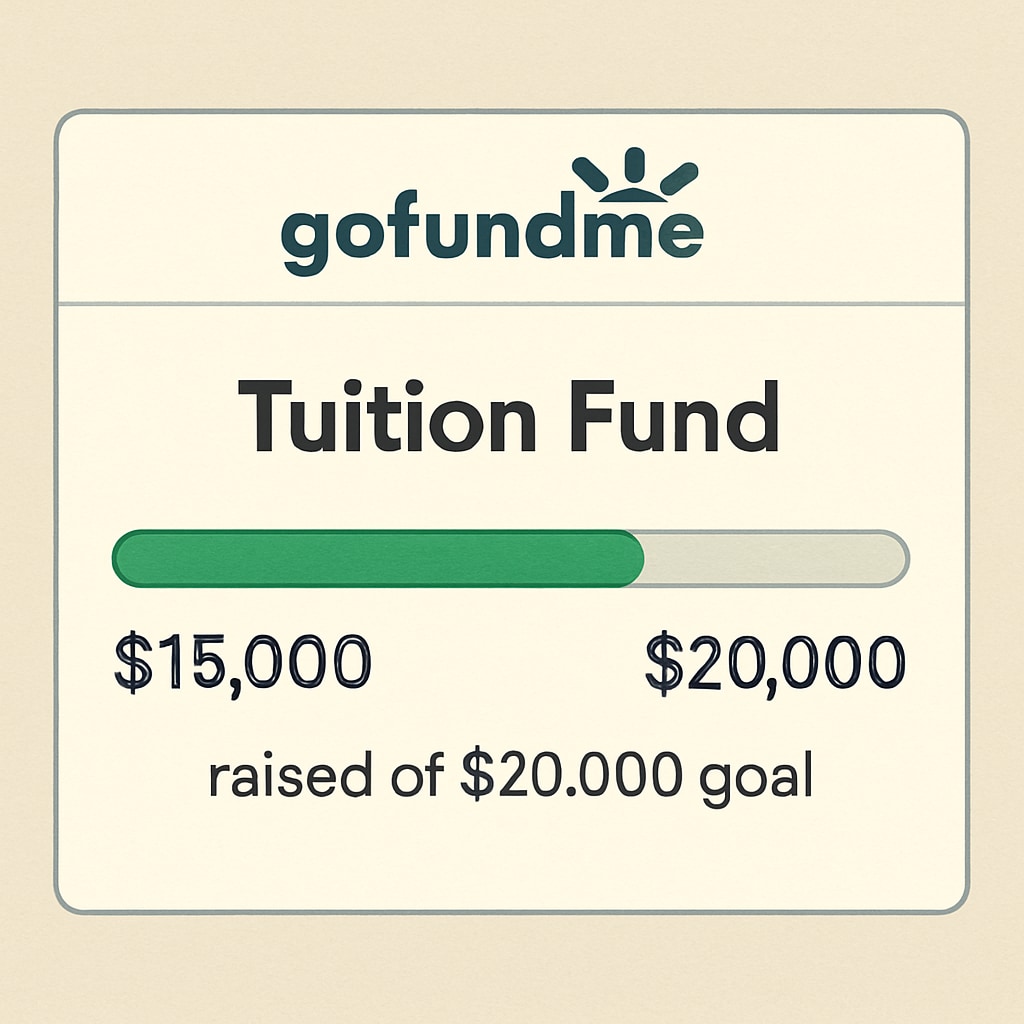

The scenario of turning to crowdfunding is not uncommon. In fact, platforms such as GoFundMe have become lifelines for students facing unexpected tuition shortfalls. While this reflects the resilience and creativity of students, it also exposes systemic flaws in how education is financed. As a result, many students are left wondering whether pursuing their academic aspirations is worth the mounting debt and financial stress.

Why Crowdfunding Has Become a Solution for Tuition

Over the past decade, crowdfunding has emerged as a powerful tool for individuals to rally financial support from their communities. For students, this approach not only provides a financial lifeline but also serves as a platform to share their stories and connect with potential donors who empathize with their struggles. However, relying on crowdfunding highlights a deeper issue: the inability of traditional financial aid systems to meet the needs of all students.

FAFSA, the cornerstone of federal student aid in the U.S., often falls short for students whose families earn above the qualifying income threshold but still cannot cover college expenses. Scholarships and grants, while helpful, are frequently limited and highly competitive. Crowdfunding, therefore, becomes a last resort for students in need of immediate funds.

- Crowdfunding platforms like GoFundMe have raised millions for educational causes.

- Students often leverage social media to amplify their campaigns and reach wider audiences.

- The process fosters transparency, as donors can directly see how their contributions are helping.

The Role of Financial Literacy in Preventing Crisis

The reliance on crowdfunding also underscores the lack of financial literacy education in K-12 schools. Many students enter college with little understanding of budgeting, loans, or the long-term impact of debt. This gap in knowledge can lead to poor financial planning, making last-minute tuition emergencies more likely.

For example, financial literacy programs could teach students how to better navigate FAFSA applications, compare loan options, and seek alternative funding sources. By equipping young people with these skills early on, we can reduce the likelihood of financial crises later in life.

Furthermore, financial literacy is especially crucial for students planning to apply to medical schools, where tuition and associated costs are significantly higher. According to the Association of American Medical Colleges (AAMC), the average medical school graduate carries over $200,000 in debt. Educating students about the financial trajectory of their chosen careers could help them make more informed decisions.

Looking Ahead: Systemic Change Is Needed

While crowdfunding has proven effective for some, it is not a sustainable solution to the larger problem of unaffordable education. Policymakers and educational institutions must address the root causes of financial strain, such as rising tuition fees and inadequate financial aid programs. Solutions could include:

- Expanding FAFSA eligibility to cover more middle-income families.

- Increasing the availability of need-based scholarships.

- Implementing financial literacy curricula in high schools nationwide.

Additionally, colleges and universities can play a role by providing emergency tuition assistance programs for students experiencing financial hardship during their final semesters. These initiatives could prevent students from dropping out due to lack of funds.

In conclusion, the story of a student crowdfunding their tuition for one last semester is both inspiring and troubling. It highlights the determination of young people to pursue their dreams despite financial obstacles, but it also serves as a reminder of the urgent need for systemic reform. As we celebrate individual resilience, we must also strive for collective solutions to ensure education remains accessible to all.

Readability guidance: The article combines short paragraphs and lists to enhance readability. It uses active voice whenever possible and incorporates transitional words to ensure a smooth flow of ideas.