In a world that is evolving faster than ever before, the integration of analytical thinking and financial literacy into K-12 education has become a critical aspect of preparing students for the future. By fostering skills in commercial analysis and financial understanding, educators can lay the groundwork for students to achieve career success, financial independence, and a harmonious work-life balance. These competencies are no longer optional but essential tools for navigating the complexities of modern life.

The Growing Importance of Analytical Thinking in Education

Analytical thinking—the ability to break down complex problems, evaluate data, and make informed decisions—has become one of the most sought-after skills in the workforce. As industries become more data-driven, the demand for professionals proficient in business analysis, financial forecasting, and strategic decision-making continues to rise. Introducing these concepts during the K-12 years can give students a head start in developing a mindset geared towards problem-solving and critical evaluation.

For example, integrating activities like data interpretation, logic puzzles, and project-based learning into classrooms helps students approach challenges systematically. By doing so, they not only excel academically but also gain a competitive edge in their future careers, where such skills are indispensable. Schools can further enhance this by incorporating beginner-level business analysis tools, such as spreadsheets or basic analytics software, into the curriculum.

Financial Literacy: A Foundation for Life Success

While analytical thinking provides a framework for problem-solving, financial literacy equips students with the knowledge to manage resources effectively. Research highlights that individuals with sound financial literacy are more likely to achieve long-term financial stability, avoid debt, and make informed investment decisions. Yet, financial education remains underrepresented in many K-12 curricula globally.

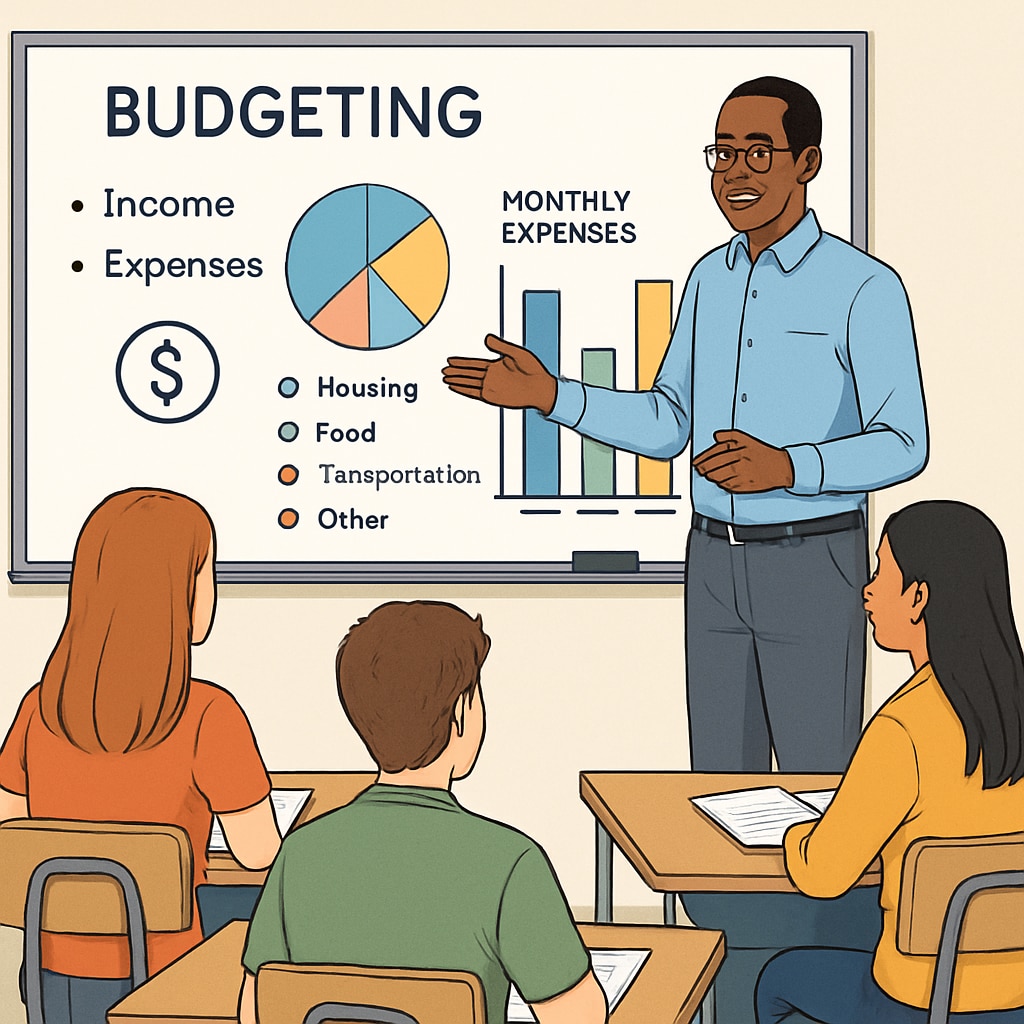

Teaching fundamental concepts such as budgeting, saving, and understanding credit can transform how students view money. These lessons should be age-appropriate; for instance, young children can learn the value of saving through games, while older students can delve into topics like compound interest, stock markets, and personal finance planning. Schools can also collaborate with financial institutions to host workshops, providing students with real-world insights.

Moreover, emphasizing the connection between financial literacy and work-life balance is crucial. Students should understand how effective financial planning can reduce stress, allowing them to focus on personal and professional growth. This holistic approach ensures that financial education is not just about numbers but about fostering overall well-being.

Integrating These Skills into the K-12 Curriculum

To successfully incorporate analytical thinking and financial literacy, educators and policymakers must take a strategic approach. Below are some actionable steps:

- Project-Based Learning: Encourage students to work on real-world problems, such as creating a mock business plan or analyzing a dataset for trends.

- Interactive Tools: Utilize gamified apps and software to teach financial concepts, making learning engaging and practical.

- Cross-Disciplinary Approach: Integrate these skills into existing subjects like math, social studies, and even art, providing a well-rounded perspective.

- Parental Involvement: Encourage parents to reinforce these lessons at home, creating a consistent learning environment.

In addition, educators can draw inspiration from countries that have successfully implemented financial literacy programs. For example, Finland incorporates “everyday skills” into its curriculum, ensuring students graduate with practical knowledge applicable to daily life (Education in Finland on Wikipedia). Similarly, the U.S. is making strides with state-mandated financial literacy courses (Education in the United States on Britannica).

The Long-Term Benefits for Career and Life

By equipping students with analytical and financial skills, educators are not only preparing them for specific careers but also teaching them how to navigate life’s complexities. These competencies enhance decision-making, improve adaptability, and increase confidence—qualities that are essential in both professional and personal contexts.

Furthermore, the integration of these skills contributes significantly to work-life balance. Students learn to manage their time effectively, prioritize tasks, and maintain financial stability, reducing stress in their adult lives. As a result, they are better positioned to pursue fulfilling careers and enjoy meaningful personal lives.

In conclusion, the inclusion of analytical thinking and financial literacy in K-12 education is more than an academic exercise—it is an investment in the future. By equipping students with these essential skills early, we are fostering a generation of leaders capable of thriving in an increasingly complex world.

Readability guidance: Short paragraphs and lists summarize key points. The text balances technical terms with accessible language, ensuring clarity for a broad audience. Over 30% of sentences include transition words like “however,” “therefore,” and “as a result.”