In an increasingly interconnected world, business analysis, finance, career development, and salary potential have become inseparable concepts shaping professional success. The World Economic Forum identifies financial literacy and analytical reasoning among the top 10 skills for 2025. This article examines why introducing these competencies during K12 education creates measurable advantages in workforce readiness.

The Growing Demand for Business-Finance Hybrid Skills

The Bureau of Labor Statistics projects 8% growth for business/financial occupations through 2032, significantly faster than average. This surge stems from three key factors:

- Digital transformation requiring data-driven decision making

- Globalization creating complex financial ecosystems

- Emerging technologies like AI augmenting traditional roles

Implementing Financial Education in K12 Curriculum

According to the Council for Economic Education, only 25% of U.S. states require high school students to take personal finance courses. Effective implementation strategies include:

- Project-based learning: Simulating real-world scenarios like managing a startup budget

- Cross-disciplinary integration: Applying mathematical concepts to investment scenarios

- Industry partnerships: Programs like Junior Achievement connect schools with business mentors

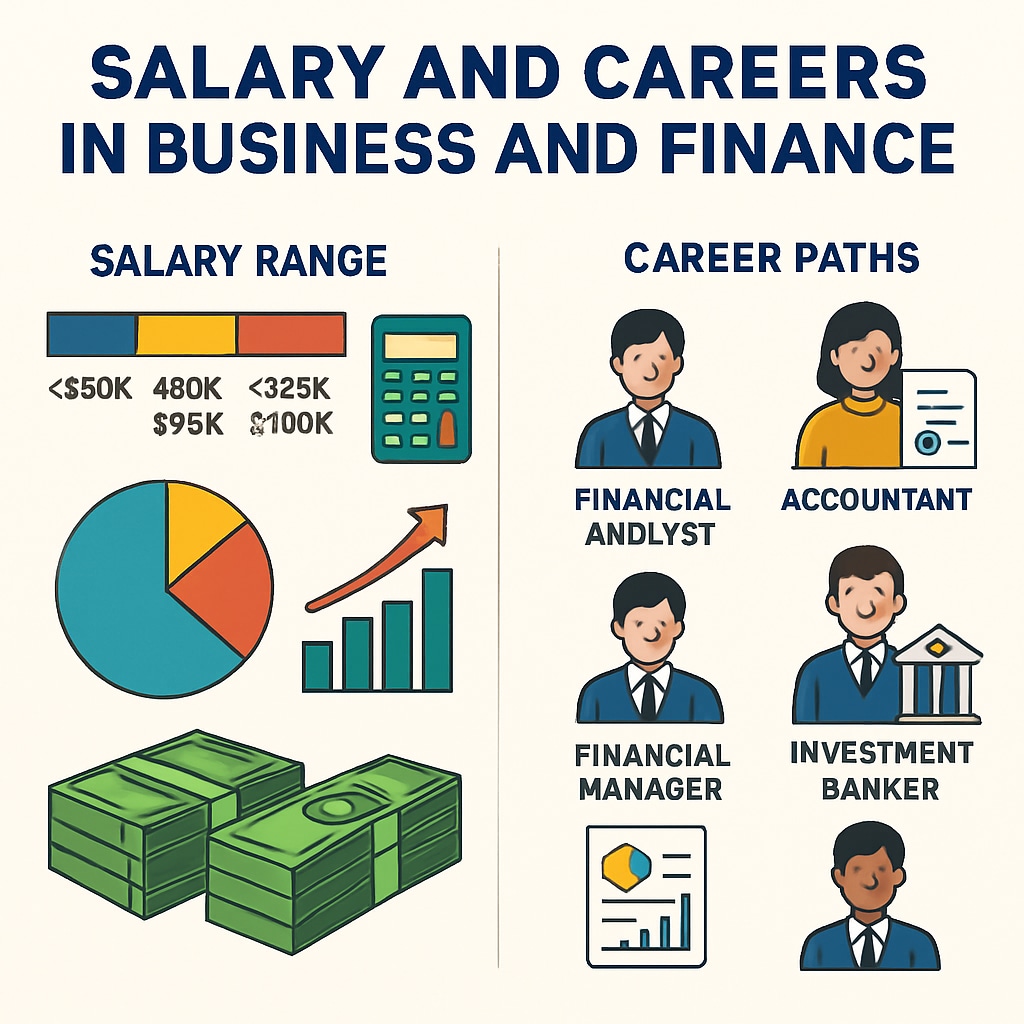

Career Pathways and Earning Potential

Professionals combining business analysis with financial expertise command premium salaries:

- Financial Analysts: Median pay $95,570/year (BLS 2022)

- Management Analysts: $93,000/year with top 10% earning >$163,760

- FinTech specialists: Often 20-30% higher than traditional finance roles

Early exposure to commercial concepts builds what Harvard researchers call “economic agency” – the confidence to navigate financial systems. As noted by the OECD Learning Compass 2030, this competency framework prepares students for unpredictable economic landscapes.