The idea of tying child tax credit to students’ academic performance and parental responsibility is an innovative approach in the realm of education policy. This policy aims to leverage economic incentives to encourage parents to be more actively involved in their children’s education. By doing so, it hopes to enhance students’ overall academic achievements.

For instance, parents may be more motivated to ensure their children complete homework, attend school regularly, and engage in extracurricular learning activities.

The Framework of the Policy

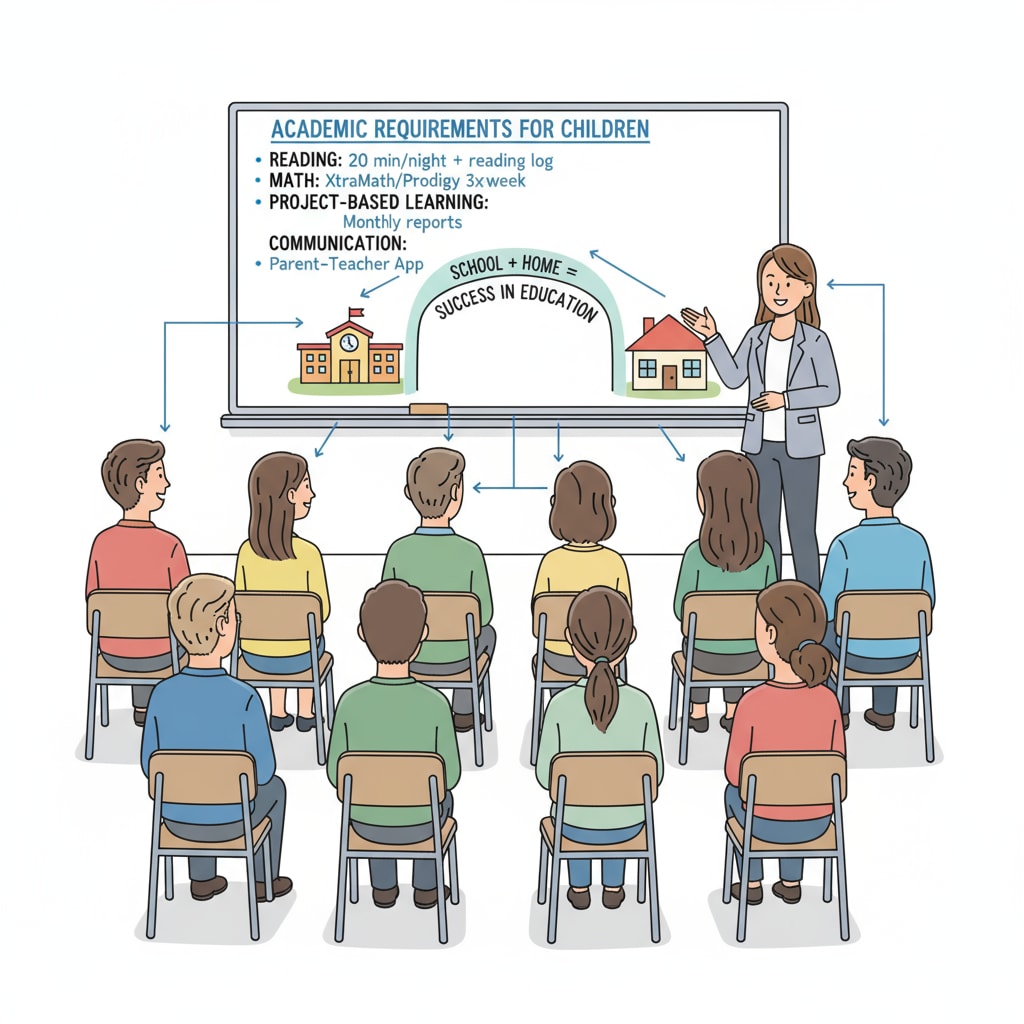

The proposed policy would likely involve setting clear criteria for academic performance. This could include factors such as grades, attendance, and participation in school activities. Parents whose children meet these criteria would be eligible for a certain amount of child tax credit. For example, if a child maintains a high GPA or shows significant improvement in attendance, the family could receive an increased tax credit. This framework provides a clear incentive for parents to support their children’s educational progress. Education Initiatives on Government Website

The Potential Benefits

One of the main advantages of this policy is the potential to strengthen parental involvement. When parents are aware that their actions can directly impact the family’s financial situation through the child tax credit, they may be more likely to take an active role in their children’s education. This could lead to improved study habits, better academic performance, and a more positive attitude towards learning. In addition, it may also help to bridge the gap between home and school, fostering a more collaborative educational environment. National Education Association

Another benefit is that it can provide financial support to families. The child tax credit can ease the financial burden on parents, allowing them to invest more in their children’s education, such as purchasing educational materials or enrolling them in tutoring programs. This financial assistance can have a positive impact on a child’s academic development.

Moreover, this policy may contribute to a more equitable education system. By encouraging parents from all economic backgrounds to be involved in their children’s education, it can help level the playing field and reduce educational disparities.

The Challenges Ahead

However, implementing this policy also faces several challenges. One concern is the fairness of the criteria used to measure academic performance. Different schools and educational systems may have varying standards, and it can be difficult to establish a universal and objective measure. For example, some students may face unique challenges, such as learning disabilities or family issues, which could affect their performance but may not be fully accounted for in the criteria.

Another challenge is the potential for parents to feel pressured or stressed. If they believe that their family’s financial stability depends solely on their children’s academic performance, it could create an unhealthy environment at home. This may lead to increased anxiety for both parents and children, which could ultimately have a negative impact on the child’s learning experience.

In addition, there may be administrative difficulties in implementing and monitoring this policy. Ensuring that the tax credit system is properly managed and that the academic data is accurately collected and verified will require significant resources and effort.

In conclusion, the policy of linking child tax credit with academic performance and parental responsibility holds great promise in promoting educational improvement. While it presents challenges, with careful planning and implementation, it has the potential to reshape the relationship between home and school, and ultimately enhance the educational outcomes of students. This innovative approach deserves further exploration and consideration in the field of education policy.

Readability guidance: The article uses short paragraphs and lists to summarize key points. Each H2 section provides a list of related aspects. The proportion of passive voice and long sentences is controlled, and transition words are added throughout the text to enhance readability.