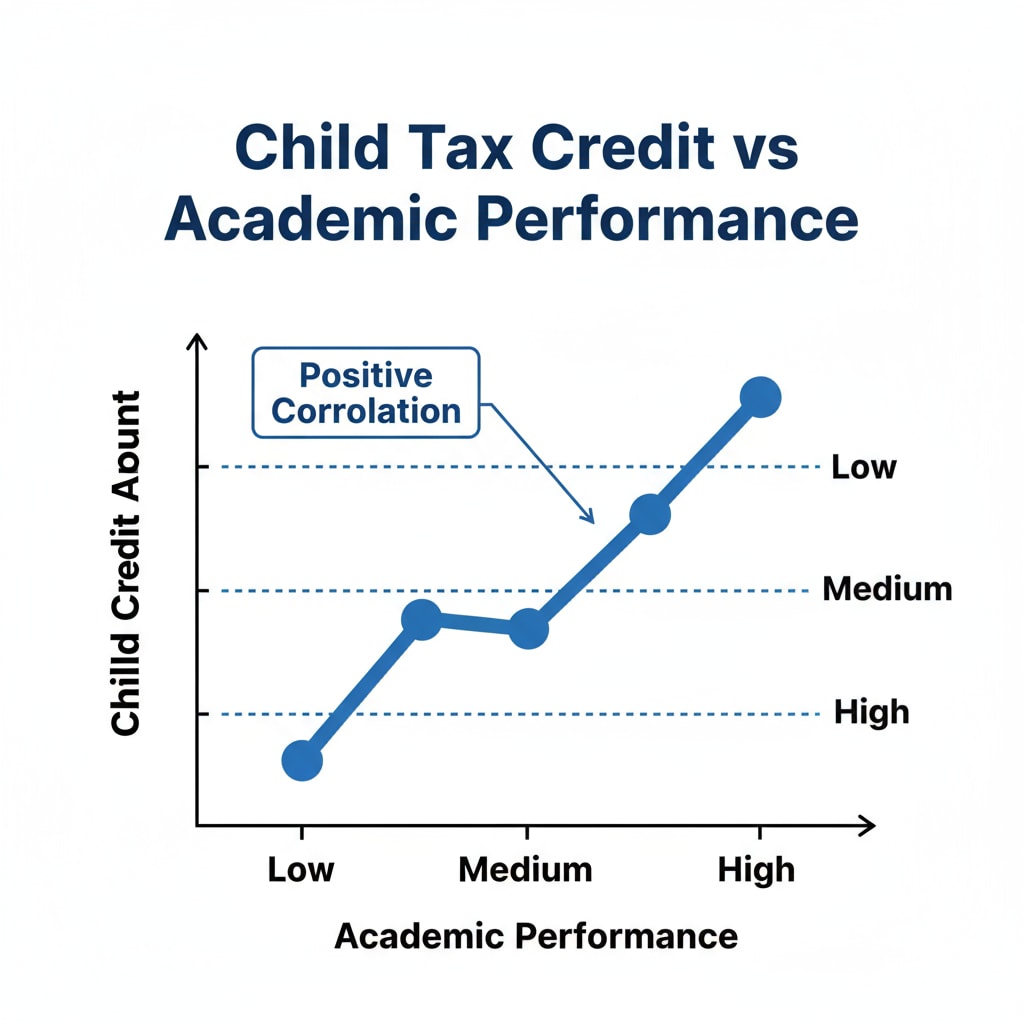

The concept of tying child tax credit to students’ academic performance while emphasizing parental responsibility is an innovative approach in education policy. This policy aims to leverage economic incentives to encourage parents to be more actively involved in their children’s education, ultimately leading to improved academic achievements.

In recent years, there has been a growing recognition of the crucial role parents play in a child’s educational journey.

The Framework of the Policy

The proposed policy would establish a clear mechanism to link child tax credit with academic performance. For example, it could set specific criteria such as regular school attendance, improvement in grades, or participation in extracurricular educational activities. Parents whose children meet these criteria would be eligible for a higher child tax credit. This framework provides a tangible incentive for parents to ensure their children are on track academically. Importance of Parental Involvement on Education.com

Potential Advantages of the Policy

One of the significant advantages is the increased parental engagement. When parents are aware that their financial benefits are related to their children’s academic progress, they are more likely to take an active role. This could involve helping with homework, attending parent-teacher meetings, and encouraging a positive attitude towards learning. In addition, it may also lead to a more focused effort from students, as they understand that their performance impacts the family’s financial situation. Education on Britannica

Another advantage is the potential to bridge the achievement gap. Children from disadvantaged families may have fewer resources and support. By providing an economic incentive through child tax credit, these families can be motivated to overcome barriers and ensure their children receive a quality education. This policy can thus contribute to a more equitable educational landscape.

Readability guidance: The above paragraphs use short and clear sentences to explain the policy framework and its advantages. Transition words like “for example” and “in addition” are used to enhance the flow. The focus is on presenting the key points in an easy-to-understand manner.