The idea of tying child tax credit to students’ academic performance is a revolutionary concept that intertwines the realms of child tax credit, academic performance, and parental responsibility. This proposed policy has the potential to bring about significant changes in the educational landscape.

As we analyze this innovative approach, it’s essential to understand the various aspects it encompasses.

The Concept of Linking Child Tax Credit to Academic Performance

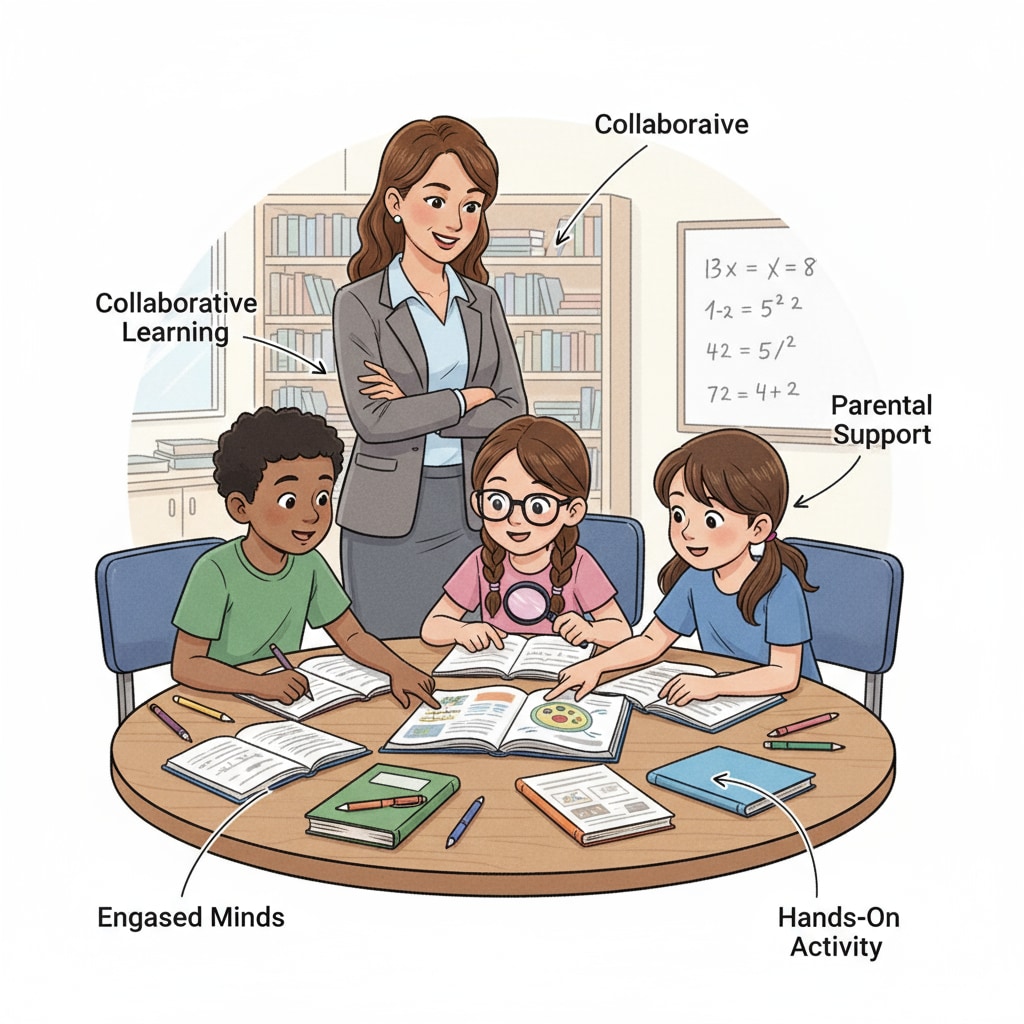

This policy proposal aims to use economic incentives to boost academic performance. By connecting child tax credit, which is a financial benefit for parents with children, to how well a student does in school, it encourages parents to be more involved. For example, if a child shows improvement in grades, parents may receive a larger tax credit. According to IRS information on child tax credit, this could potentially reshape the way parents engage with their children’s education.

The Role of Parental Responsibility in this Equation

Parental responsibility takes on a new dimension with this policy. Parents are now more likely to actively participate in their children’s learning process. They may spend more time helping with homework, attending parent-teacher meetings, and encouraging their kids to do well. In addition, this could lead to a more supportive home environment for learning. As stated by the National Education Association on parental involvement, parental engagement is crucial for a child’s academic success.

The potential impacts of this policy are far-reaching. It could lead to an overall improvement in academic performance as students receive more support at home. Moreover, it might also bridge the gap between different socioeconomic groups in terms of educational attainment. However, it’s important to consider the potential drawbacks as well, such as the pressure it could place on students and parents.

Readability guidance: This article uses short paragraphs and lists to summarize key points. Each H2 section provides a clear focus. The passive voice and long sentences are kept to a minimum, and transition words are used throughout to enhance readability.