As college tuition continues to rise, financially disadvantaged students face unprecedented challenges in pursuing higher education. Many turn to crowdfunding platforms like GoFundMe to bridge the gap and make their academic dreams a reality. This growing trend highlights the urgent need to equip students with financial literacy, resource-gathering skills, and social support networks during their K12 years. By addressing these areas early, students can better navigate the financial hurdles that may arise in their pursuit of education.

Why Crowdfunding Has Become a Lifeline for Students

In recent years, the cost of higher education has skyrocketed, leaving many families unable to afford college tuition. According to the Education Data Initiative, the average annual cost of attending a four-year college in the United States exceeds $35,000. For low-income families, this figure is simply out of reach. Crowdfunding platforms, particularly GoFundMe, have emerged as a popular solution for students to seek financial support directly from their communities.

These platforms work by allowing students to share their stories, outline their goals, and request monetary contributions. While they offer a way to fund education, relying on crowdfunding also has its limitations, including the need for extensive promotion and the unpredictability of reaching financial targets. This underscores the importance of preparing students early for financial independence and resilience.

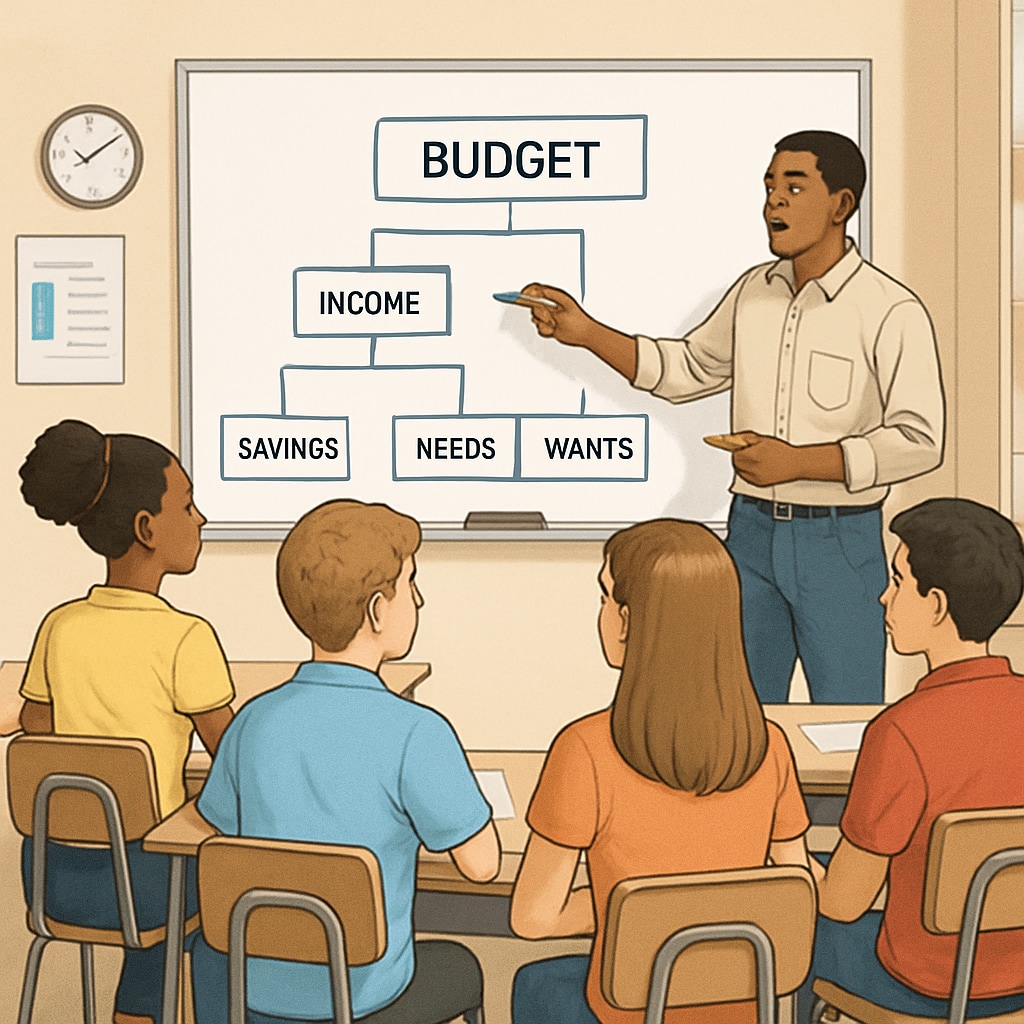

Building Financial Literacy in K12 Education

Financial literacy is a cornerstone for addressing educational funding challenges. By introducing financial concepts during the K12 years, students can develop essential skills such as budgeting, saving, and understanding loans. For example, students who understand how compound interest works are more likely to make informed decisions about student loans and other financial products.

Schools can implement programs that teach practical financial habits, such as managing a savings account or creating a budget for daily expenses. These lessons not only prepare students for college but also equip them with lifelong skills. Additionally, integrating real-world scenarios, such as crowdfunding for a project, can help students understand the dynamics of fundraising and the importance of clear communication when seeking financial support.

Leveraging Community Support and Resources

Another critical aspect of preparing students for future financial challenges is fostering strong community support networks. Students who feel connected to their communities are more likely to receive emotional and monetary assistance when needed. Schools and community organizations can play a pivotal role in this by creating mentorship programs, offering scholarships, and connecting families with local resources.

For instance, students can benefit from workshops on grant writing or public speaking, which are valuable skills for promoting crowdfunding campaigns. Additionally, partnerships with local businesses can provide opportunities for internships or part-time jobs, helping students save for their education while gaining work experience.

From Crowdfunding to Financial Independence

While crowdfunding platforms like GoFundMe offer a lifeline for students facing immediate financial challenges, the ultimate goal should be to equip them with the tools to achieve financial independence. This involves not only literacy and resource-building but also fostering a mindset of resilience and adaptability.

For parents, educators, and policymakers, the challenge lies in creating a system where students are prepared to tackle educational costs without compromising their dreams. By investing in financial education and community support during the K12 years, we can empower students to confidently face the financial realities of higher education and beyond.

In conclusion, the intersection of education, economics, and social support underscores the importance of early preparation. Crowdfunding is a stepping stone for many students, but long-term success requires a foundation of knowledge, resources, and community connections. As the cost of education continues to rise, addressing these areas during a student’s formative years is more critical than ever.

Readability guidance: Use short paragraphs and bulleted lists where appropriate. Minimize passive voice and long sentences. Incorporate transition words (e.g., “however,” “therefore,” “in addition”) to maintain flow and clarity.