Pursuing financial careers in developing countries like Mali often involves navigating significant challenges, including limited access to quality education, the need for self-learning, and difficult decisions around study abroad options. For Mali to develop local financial talent capable of driving economic growth, it is essential to begin fostering financial literacy and career planning in the K12 education stage.

Addressing Education Barriers in Developing Countries

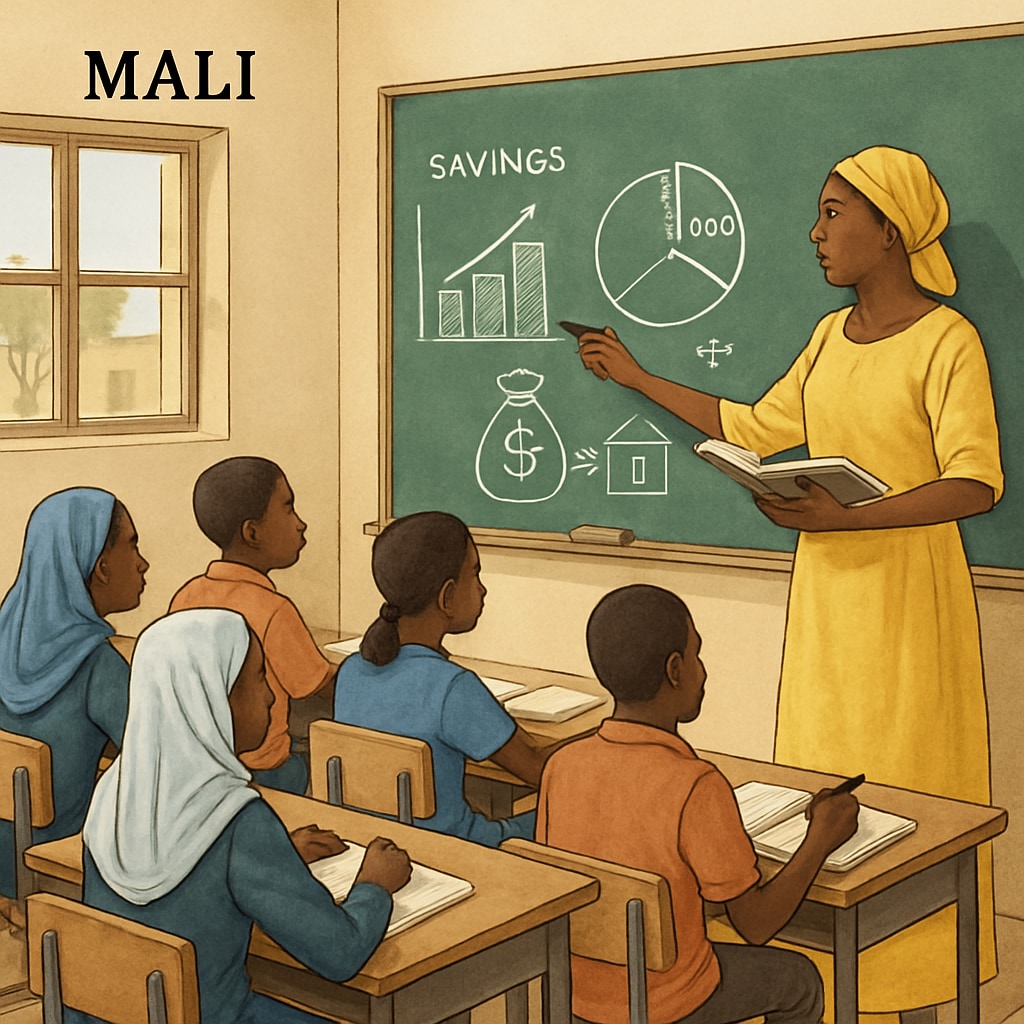

In many developing countries, the education system faces resource constraints, leaving students with limited exposure to financial concepts and career planning. This presents a major obstacle for those aspiring to enter financial professions. For example, in Mali, many schools lack specialized curricula that teach financial literacy, skills such as budgeting, or an understanding of global financial systems.

To counteract these challenges, governments and NGOs can play a role by introducing basic financial education programs at the K12 level. These programs should focus on practical applications, such as how to manage personal finances, understand economic principles, and explore career pathways in finance.

The Role of Self-Learning and Online Resources

When traditional education falls short, motivated students can turn to self-learning as a viable alternative. Online platforms like Khan Academy and Coursera offer free or affordable courses on financial literacy, economics, and accounting. These resources enable students in Mali and similar countries to build foundational knowledge independently.

However, self-learning comes with its own challenges, including the need for reliable internet access and self-discipline. Students may also require mentoring or career guidance to apply their knowledge effectively. Local organizations could bridge this gap by providing mentorship programs and facilitating community-based learning initiatives.

Making Study Abroad Choices

For many students in Mali, pursuing higher education abroad is seen as a pathway to better career opportunities in finance. Countries with established financial sectors, such as France or the United States, offer advanced degrees in economics and finance that can be transformative. However, studying abroad comes with high costs, cultural adjustments, and the risk of brain drain—where talented individuals remain abroad rather than returning to contribute to their home country’s economy.

To mitigate these issues, Mali could develop partnerships with foreign universities to provide scholarships or exchange programs that encourage students to return home after their studies. Additionally, local universities could collaborate with international institutions to establish joint programs that deliver world-class financial education at home.

Nurturing Local Financial Talent

Ultimately, the goal is to build a robust pipeline of local financial professionals who can drive economic development within Mali. Achieving this requires a multi-pronged approach, including:

- Integrating financial literacy and career planning into the national K12 curriculum.

- Providing access to self-learning platforms and mentorship programs.

- Developing policies that incentivize study abroad students to return home.

- Strengthening local universities’ financial education programs.

By investing in these strategies, Mali can empower its youth to pursue meaningful financial careers and contribute to the country’s long-term economic success.

Readability guidance: The article uses short paragraphs, lists, and clear transitions to ensure accessibility. It avoids excessive jargon while maintaining a professional tone, making it suitable for educators, policymakers, and aspiring students.