Modern education systems focus heavily on academic knowledge, but they often neglect critical life skills such as financial literacy and time management. Incorporating these into core school curricula can provide students with a solid foundation for adulthood, enabling them to make informed financial decisions and manage their time effectively. As the world becomes increasingly complex, students need more than theoretical knowledge—they need practical skills to thrive.

Why Financial Literacy Matters for Students

Financial literacy refers to the ability to understand and effectively use financial skills, including budgeting, investing, and saving. Despite its importance, many young adults enter the workforce or college with little understanding of these concepts, leading to poor financial decisions. For example, a lack of knowledge about interest rates or credit card debt can result in significant financial struggles later in life.

Integrating financial education into schools can provide students with tools to navigate challenges such as student loans, credit management, and retirement planning. In addition, teaching these skills early promotes long-term financial stability and reduces the likelihood of economic hardships.

- Budgeting: Helping students understand income versus expenses.

- Saving: Emphasizing the importance of setting aside money for future needs.

- Investing: Introducing basic concepts like compound interest and risk management.

Learn more about financial literacy on Investopedia.

The Importance of Time Management Skills

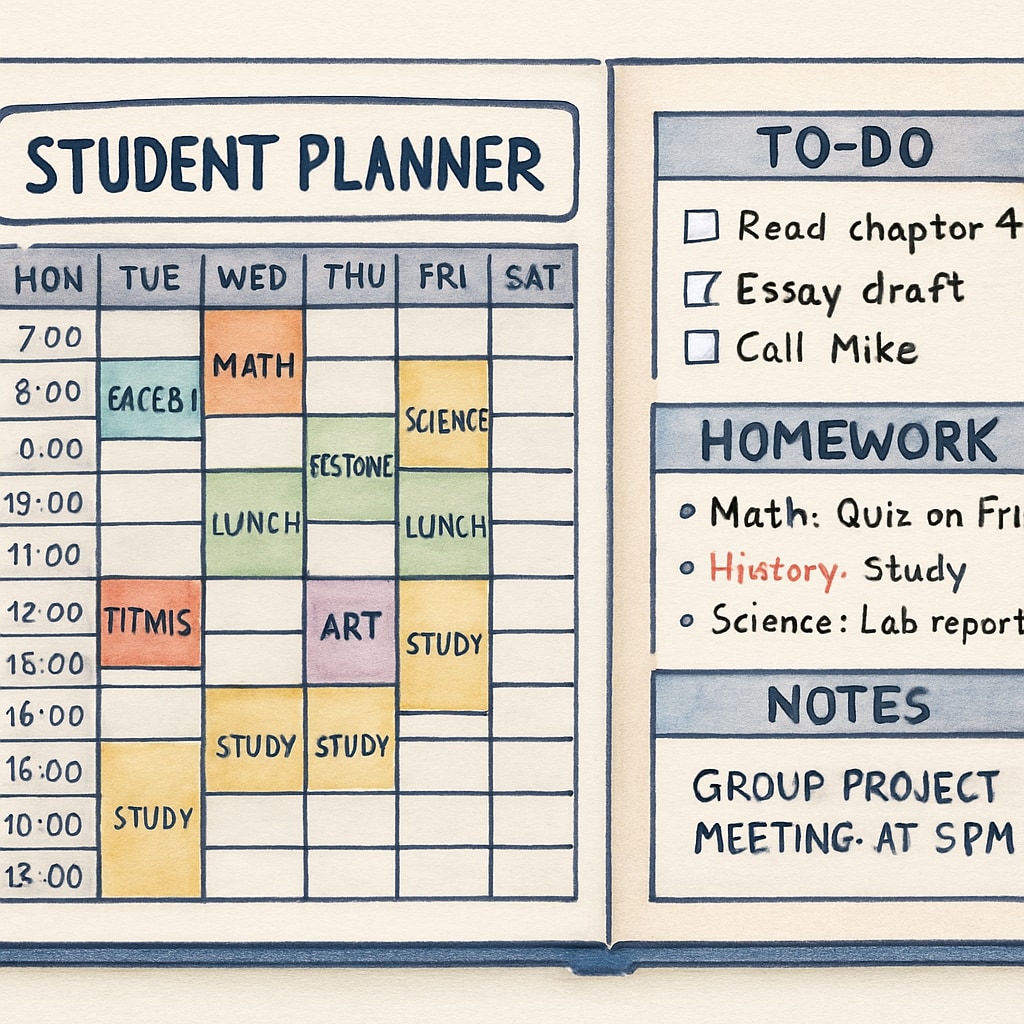

Time management is another essential skill often overlooked in traditional education. With increasing demands on students’ time, learning how to prioritize tasks, set goals, and manage schedules is crucial for academic and personal success. These skills can help students balance their studies, extracurricular activities, and social lives while also preparing them for the professional world.

For example, effective time management enables individuals to meet deadlines, reduce stress, and improve productivity. Schools that incorporate time management training into their curricula can foster a culture of efficiency and resilience among students.

How Schools Can Integrate Financial and Time Management Education

To make financial literacy and time management part of the core curriculum, schools need to adopt a systematic approach. This can include:

- Dedicated courses: Offering classes specifically focused on financial literacy and time management.

- Interdisciplinary integration: Incorporating these topics into existing subjects such as mathematics or social studies.

- Practical projects: Assignments that simulate real-world scenarios, such as creating a budget or planning a weekly schedule.

- Guest speakers: Inviting financial experts and productivity coaches to share insights.

By taking steps like these, schools can prepare students not only for academic success but also for life beyond the classroom. This approach aligns education with real-world demands and fosters a generation of empowered and capable individuals.

Explore why financial literacy matters in schools on Edutopia.

Conclusion: Bridging the Gap in Education

As society evolves, the need for practical life skills like financial literacy and time management becomes increasingly evident. Schools have a unique opportunity to prepare students for adult responsibilities by teaching them how to manage money and time effectively. By making these subjects part of the core curriculum, educators can ensure that students graduate not only with academic knowledge but also with the tools they need to succeed in life.

Incorporating these lessons into education is not just a matter of curriculum reform—it is a crucial step toward equipping students to face the realities of adulthood confidently. The impact of such changes will ripple across generations, creating individuals who are financially savvy and well-prepared to manage their time and resources.