In today’s education system, there is a growing emphasis on academic excellence while practical life skills like financial literacy, school curriculum, and life skills are often overlooked. Students graduate with knowledge of history, science, and mathematics but remain unprepared to manage their finances or time effectively in adulthood. This gap in education raises a critical question: Why aren’t these essential skills part of the core curriculum? Addressing this issue is vital to ensuring that students are equipped for real-world challenges.

Why Financial Literacy Matters

Financial literacy (understanding personal finance, budgeting, and investments) is fundamental for navigating adulthood. Without these skills, young adults may struggle with debt, savings, and financial planning, leading to long-term consequences. For example, studies show that financial illiteracy correlates with higher credit card debt and insufficient retirement savings among adults. Including financial education in schools not only helps students understand concepts like compound interest but also fosters habits that lead to financial independence.

The Role of Time Management in Success

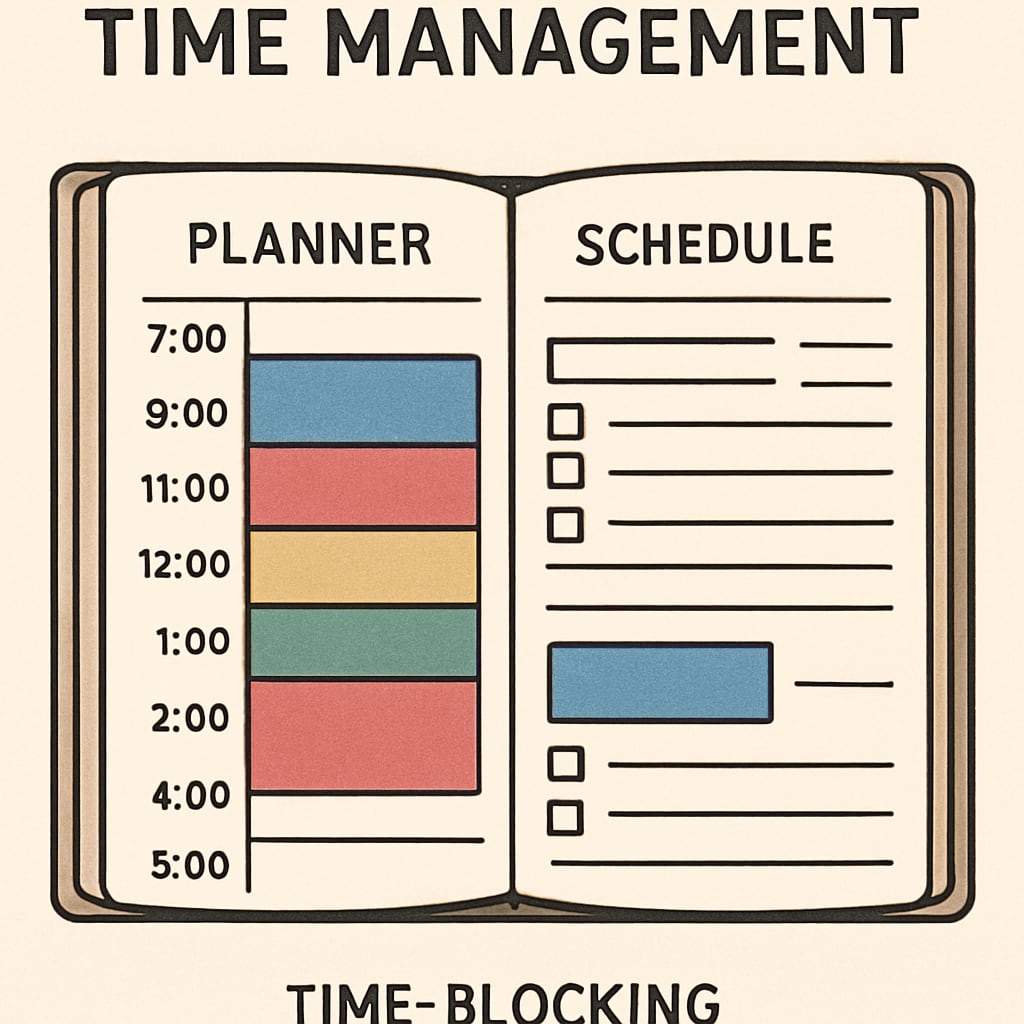

Time management is equally important as financial education. Students frequently face pressure to balance academics, extracurricular activities, and social commitments. Teaching effective time management techniques, such as prioritizing tasks and setting achievable goals, can help them excel in their studies and beyond. These skills become even more critical in adulthood, where managing work deadlines and personal responsibilities is a daily necessity.

Integrating Life Skills into School Curriculums

To address these gaps, schools should incorporate financial literacy and time management into their core curriculums. Here are some practical steps to achieve this:

- Introduce age-appropriate financial education starting in middle school, covering topics like saving, budgeting, and investments.

- Develop interactive workshops that simulate real-world financial scenarios, such as managing a monthly budget or understanding loan terms.

- Teach time management strategies through hands-on activities, such as creating daily planners or setting SMART goals.

- Collaborate with local financial experts and organizations to provide valuable resources and mentorship opportunities.

By integrating these subjects, students can gain practical knowledge that complements their academic learning and prepares them for adulthood.

Real-Life Benefits of Financial and Time Management Skills

When students understand financial literacy and time management, they gain tools to make informed decisions. For instance, a student who understands budgeting is less likely to fall into debt when managing personal expenses. Similarly, effective time management can reduce stress and improve productivity in both academic and professional settings. These skills create a foundation for lifelong success.

Learn more about financial literacy on Wikipedia and time management on Britannica.

As schools rethink their curriculums, integrating financial and time management education should take center stage. These life skills not only empower students but also prepare them to contribute positively to society. The long-term benefits of such education are undeniable, making this a necessary step for modern education systems.

Readability guidance: Use concise paragraphs and bullet points to emphasize key ideas. Include relatable real-world examples to engage readers. Maintain a professional yet accessible tone throughout.