Modern education systems focus heavily on academic subjects, yet they often overlook crucial life skills such as financial education, time management, and school courses. These skills are vital for navigating adulthood successfully, but without formal training in schools, students are left to learn them through trial and error, often at a significant cost. Incorporating financial literacy and time management into K12 curricula is essential to better equip students for the challenges of the real world.

Why Financial Education Is a Lifelong Necessity

Financial education teaches students how to manage money, create budgets, and understand concepts like savings, investments, and debt. These skills are indispensable in adulthood, yet many adults struggle due to a lack of early exposure to financial principles. For example, studies show that individuals with financial literacy are more likely to avoid debt traps and build wealth over time (Financial literacy on Investopedia). By introducing these skills in schools, children can develop responsible financial habits early.

Time Management: The Key to Productivity and Balance

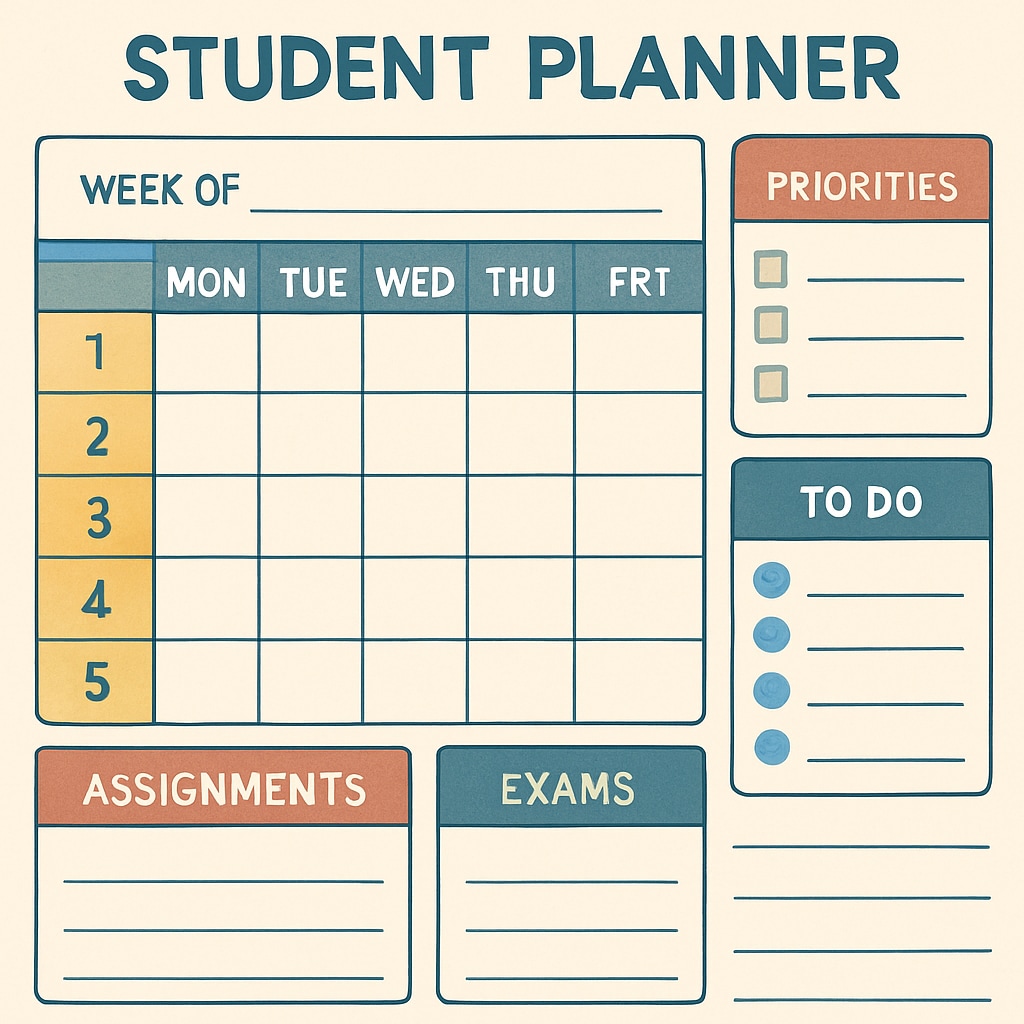

Time management is another critical life skill that is often ignored in traditional school curricula. Students face increasing workloads, extracurricular activities, and personal commitments as they grow older, making effective time management essential for their success. Teaching time prioritization, scheduling, and goal setting can empower students to handle their responsibilities efficiently and reduce stress. For instance, a structured approach to managing time can boost productivity and create a strong foundation for professional life (Time management on Wikipedia).

Integrating Financial and Time Management Skills into K12 Curricula

Incorporating financial and time management education into K12 schools requires thoughtful planning. Here are practical strategies for introducing these subjects:

- Dedicated Courses: Design specific classes focused on financial literacy and time management skills.

- Interactive Learning: Use simulations, games, and real-world scenarios to make lessons engaging and practical.

- Cross-Disciplinary Integration: Embed these skills into existing subjects like mathematics, economics, or social studies.

- Parental Involvement: Encourage parents to reinforce these lessons at home for consistent learning.

These strategies not only make the curriculum more relevant but also prepare students for their future roles as independent adults.

The Benefits of Early Exposure to Life Skills

Teaching financial literacy and time management in schools has long-term advantages. Students who master these skills tend to exhibit:

- Improved decision-making abilities

- Higher productivity and less procrastination

- Greater financial independence

- Reduced stress and better mental health

As a result, they are better prepared to manage their personal and professional lives effectively. Early exposure to these essential skills can bridge the gap between academic knowledge and practical life application.

To summarize, the integration of financial education, time management, and school courses into K12 curricula is no longer optional—it is a necessity. Educators, policymakers, and parents must work collaboratively to ensure students receive the tools they need to thrive in the real world. By prioritizing these skills, schools can create a generation of well-prepared, confident, and capable individuals.