For thousands of ambitious students in the United States, the dream of higher education often collides with the harsh realities of tuition struggles. Platforms like GoFundMe have become lifelines for students facing financial obstacles, especially for those navigating the competitive world of medical school applications. This article highlights the story of one determined student using crowdfunding to overcome these challenges and examines how early educational preparedness can play a role in mitigating financial burdens.

Why Crowdfunding is Becoming a Solution to Tuition Struggles

In the past decade, the cost of higher education in the U.S. has skyrocketed. According to the National Center for Education Statistics, the average cost of tuition at private institutions reached over $37,000 annually, while public universities charge an average of $10,000 per year for in-state students. These figures don’t account for additional expenses such as housing, textbooks, and transportation. For students aspiring to attend medical school, these costs can be even more overwhelming.

Crowdfunding platforms, such as GoFundMe, have emerged as popular avenues for students seeking financial support. By creating personal campaigns, individuals can share their stories and connect with potential donors who resonate with their struggles and aspirations. While not a guaranteed solution, crowdfunding offers an alternative path for students who might otherwise abandon their dreams due to financial barriers.

One Student’s Journey Toward Medical School

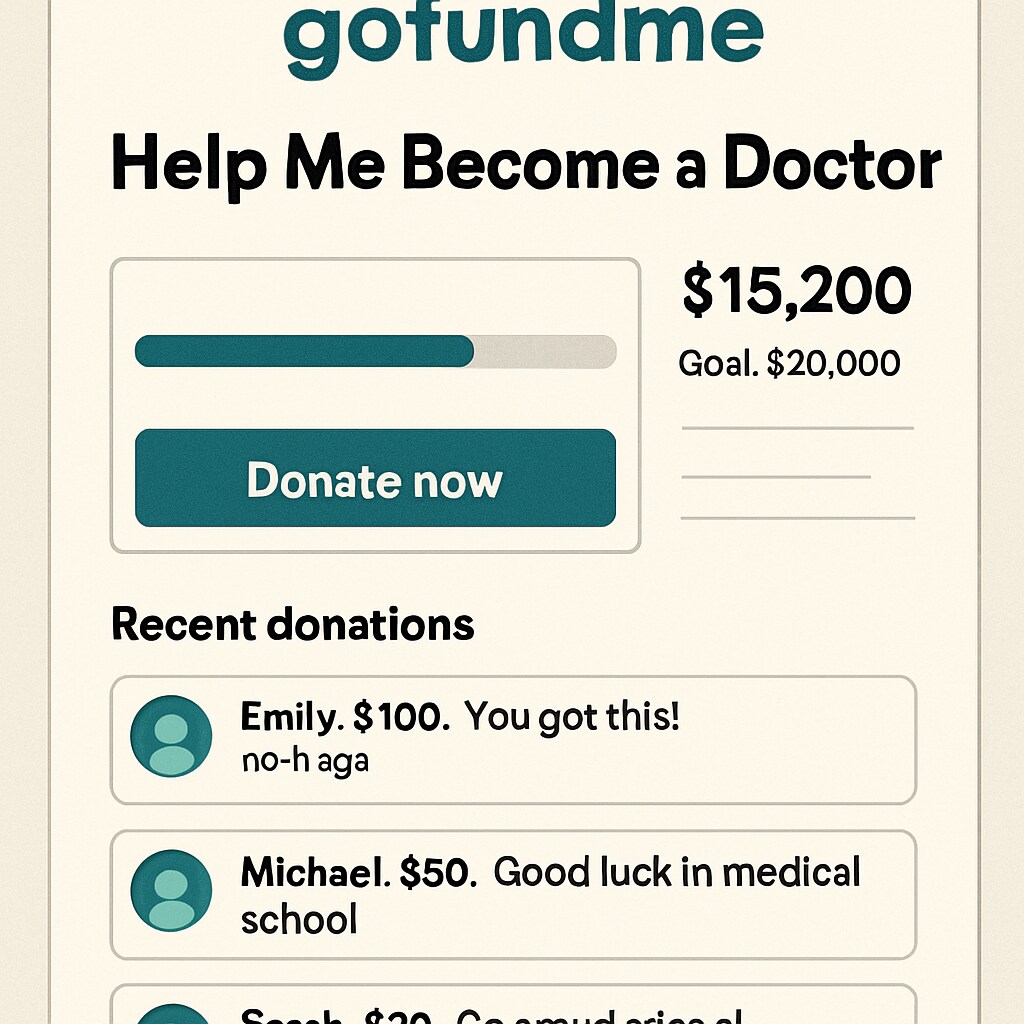

Among the countless stories of students turning to crowdfunding is that of Sarah Johnson (name changed for privacy), a pre-med student with aspirations to become a pediatrician. Despite excelling academically, Sarah faced insurmountable tuition and application fees when applying to medical school. Frustrated by limited scholarship options and the fear of taking on significant debt, she decided to launch a GoFundMe campaign.

Her campaign outlined her goals, challenges, and dedication to serving underprivileged communities through healthcare. Within weeks, Sarah’s story gained traction, and she raised over $15,000—enough to cover her application fees and a portion of her tuition. Her success serves as an inspiring example of how crowdfunding can bridge the gap between ambition and accessibility.

Preparing Students Early: Financial Literacy in K-12 Education

While stories like Sarah’s are inspiring, they also raise critical questions about the financial preparedness of students entering higher education. Many high school graduates lack basic financial literacy, including understanding student loans, scholarships, and budgeting for tuition-related expenses. This gap in knowledge often leaves students unprepared for the financial demands of college life.

Experts suggest integrating financial education into K-12 curricula to equip students with tools to navigate these challenges. For example:

- Teaching students about loan repayment terms and interest rates.

- Providing workshops on scholarship applications and grant opportunities.

- Offering courses on budgeting and managing personal finances.

By addressing these issues early, educators can empower students to make informed decisions about their educational paths, reducing their reliance on crowdfunding platforms later in life.

The Larger Implications of Crowdfunding in Education

While crowdfunding can be a powerful tool, it is not without its limitations. For instance, campaigns often depend on an individual’s ability to market their story effectively, which can disadvantage students who lack access to social networks or promotional resources. Additionally, the reliance on crowdfunding highlights systemic issues within higher education, such as the lack of affordable tuition options and limited scholarship availability.

To address these challenges, policymakers and institutions must collaborate to create sustainable solutions. This includes increasing funding for public universities, expanding scholarship programs, and reducing the overall cost of medical school applications. By tackling these root causes, the need for crowdfunding could diminish over time.

Conclusion: Crowdfunding platforms like GoFundMe are empowering students to overcome tuition struggles and pursue their dreams, especially in fields like medicine. However, their popularity also underscores significant gaps in affordability and financial preparedness within the current education system. By incorporating financial literacy into K-12 education and advocating for systemic reforms, society can better support students in achieving their aspirations without the constant fear of financial hardship.