For many students, completing their education is a dream that can be derailed by the rising costs of tuition. This is especially true for aspiring medical students, where the financial burden of tuition can become insurmountable in the final stages of their academic journey. The barriers of tuition struggles, crowdfunding, and the aspiration to apply for medical school are intertwined issues that reflect the broader challenges of modern higher education. In this article, we will explore how economic factors impact educational continuity, the role of crowdfunding in addressing financial hurdles, and the importance of cultivating financial literacy early in the K12 education system.

Understanding the Impact of Tuition Struggles on Education

The rising cost of higher education has created a significant barrier for students, particularly those from low-income families. According to data from the National Center for Education Statistics, the average cost of attending a four-year public college has increased by over 200% in the last three decades. As a result, students are often forced to delay their studies, drop out, or take on substantial debt that can follow them for years after graduation. For medical students, this financial burden is even greater, as they face not only high tuition fees but also additional costs such as exam fees, residency applications, and living expenses.

When students are unable to pay for their final semester, the consequences can be devastating. Years of effort and investment are at risk of going to waste, and their career aspirations are put on hold indefinitely. This issue underscores the need for accessible financial support systems that enable students to complete their education without disruption.

Crowdfunding as a Lifeline for Struggling Students

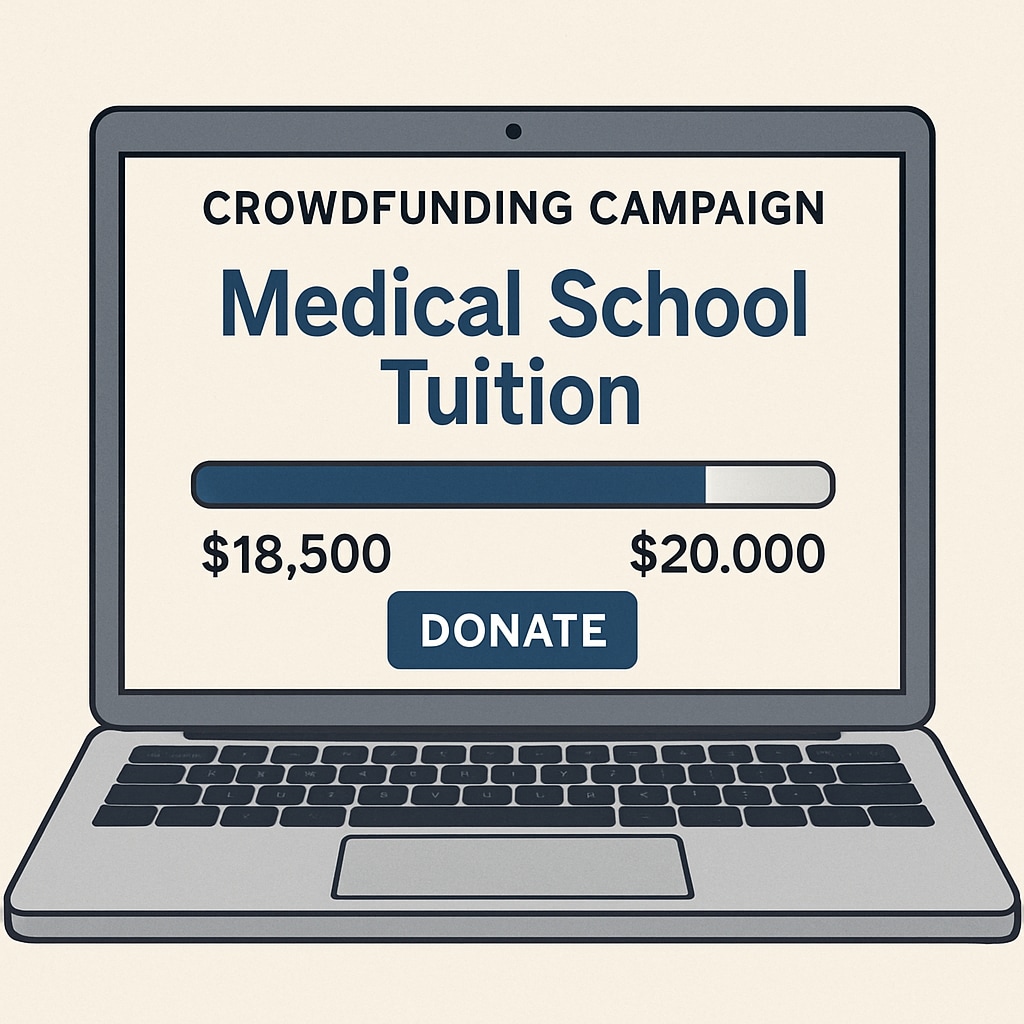

In recent years, crowdfunding platforms have emerged as a popular way for students to raise money for their education. Websites like GoFundMe and Kickstarter have provided an accessible avenue for individuals to share their stories and seek support from their communities. These platforms have been particularly beneficial for students facing emergency financial situations, offering a quick and straightforward way to gather funds.

For example, an aspiring medical student who is unable to pay for their final semester might create a crowdfunding campaign detailing their journey, accomplishments, and future goals. By sharing their story on social media, they can reach a wide audience of potential donors who are willing to contribute to their cause. Crowdfunding not only provides financial relief but also fosters a sense of community and shared responsibility for supporting education.

However, it is important to note that crowdfunding is not a guaranteed solution. Success often depends on the student’s ability to effectively communicate their needs and connect with a supportive audience. Additionally, the reliance on crowdfunding highlights the broader systemic issue of inadequate funding and support for higher education.

The Role of Financial Literacy in Preventing Tuition Crises

While crowdfunding can provide immediate relief, it is essential to address the root causes of tuition struggles by equipping students with the tools they need to manage their finances effectively. Financial literacy education should begin in the K12 system, where students can learn about budgeting, saving, and planning for future expenses. By fostering these skills early on, students will be better prepared to navigate the financial challenges of higher education.

In addition to personal financial skills, schools and universities should offer comprehensive support systems that include financial aid counseling, scholarship programs, and emergency grants. These resources can help students make informed decisions about their education and reduce the likelihood of encountering financial crises in the future.

A Holistic Approach to Supporting Students

Addressing the challenges of tuition struggles requires a collaborative effort from educators, policymakers, and communities. Some strategies to consider include:

- Expanding access to need-based scholarships and grants

- Promoting employer-sponsored tuition assistance programs

- Encouraging public and private partnerships to fund education

- Integrating financial literacy into school curricula

By taking a proactive and comprehensive approach, we can create an education system that empowers students to achieve their goals without being hindered by financial barriers.

In conclusion, the struggles of tuition, crowdfunding, and the dream of applying for medical school are emblematic of the broader challenges facing higher education today. While crowdfunding offers a valuable lifeline for students in need, it is not a substitute for systemic change. By prioritizing financial literacy and providing robust support systems, we can ensure that no student’s future is derailed by the cost of education.

Readability guidance: This article uses short paragraphs, clear headings, and lists to enhance readability. Transition words such as “however,” “therefore,” and “in addition” are used throughout to ensure a smooth flow of ideas.