When analyzing school budgets, terms like “pass-through funds,” “per-student spending,” and “education financing” frequently appear. However, these metrics can sometimes paint a misleading picture of how education dollars are allocated. Pass-through funds, in particular, can significantly distort per-student spending data, leading to misconceptions about a school district’s actual financial health. This article delves into the mechanics of pass-through funds, their impact on per-student expenditure statistics, and why transparent accounting practices are critical for equitable resource allocation.

What Are Pass-Through Funds and How Do They Work?

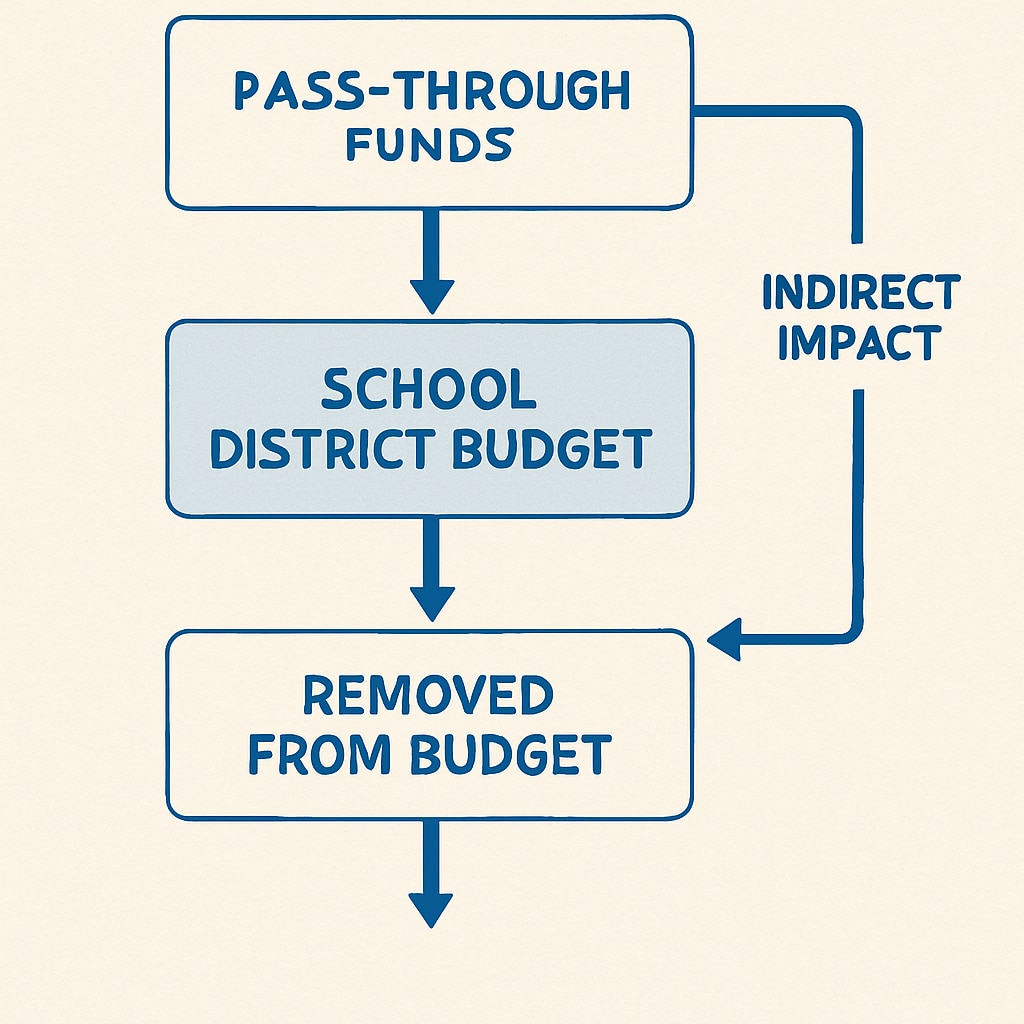

Pass-through funds refer to money allocated by federal or state governments to school districts, which then “pass through” to other entities or programs. These funds are often earmarked for specific purposes, such as special education, transportation, or extracurricular programs. While they technically appear as part of a district’s budget, they are not entirely under the district’s discretionary control.

For instance, a state government might allocate funds to a school district for special-needs programs, which are then directed to third-party service providers. Although the money flows through the district’s budget, it does not directly benefit every student. This can lead to inflated per-student spending figures that do not reflect the actual resources available in classrooms.

How Pass-Through Funds Affect Per-Student Spending Calculations

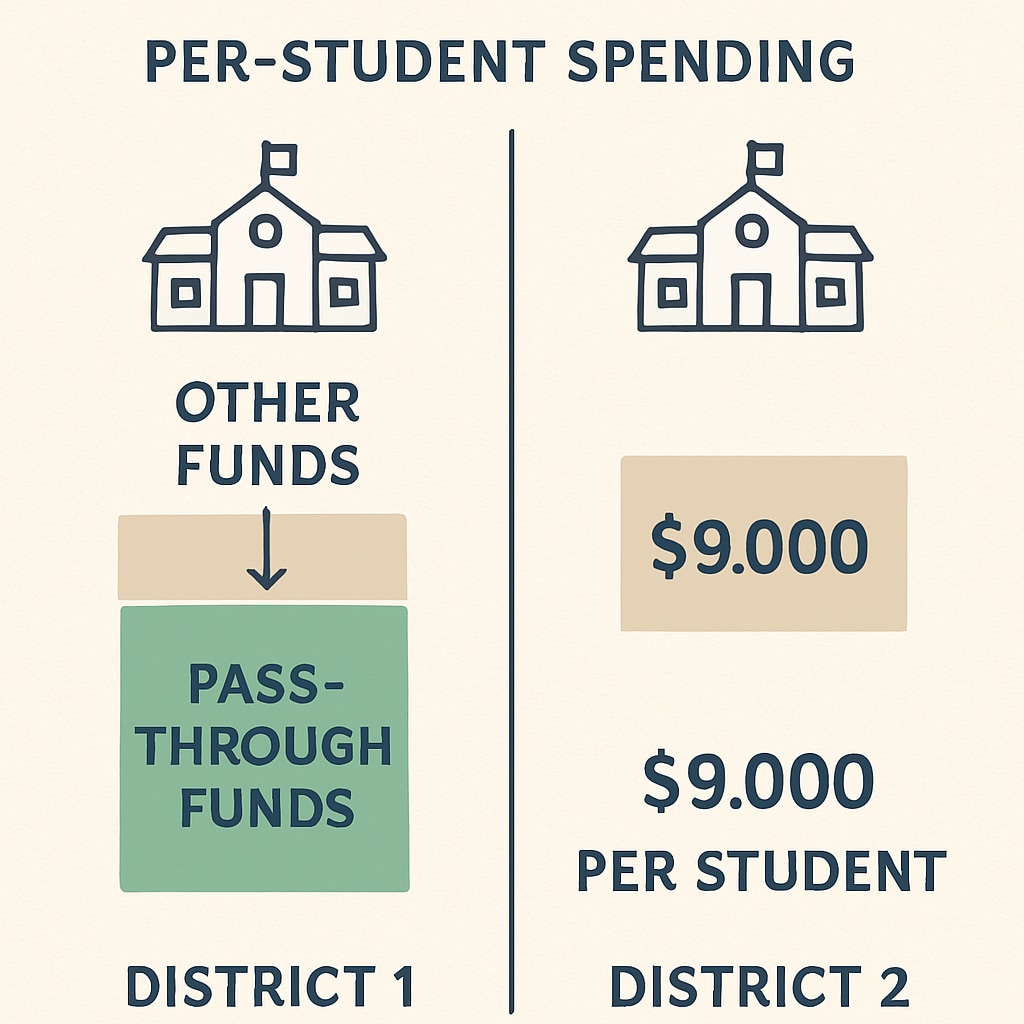

Per-student spending is a commonly used metric to evaluate the quality of education funding. It is calculated by dividing the total budget of a school district by its student enrollment. However, pass-through funds can artificially inflate this figure, as they are included in the total budget without necessarily impacting spending at the classroom level.

For example:

- A district with $100 million in total funding and 10,000 students reports $10,000 per-student spending.

- If $20 million of that budget consists of pass-through funds earmarked for external services, the actual classroom spending may be closer to $8,000 per student.

This disconnect can lead to inaccurate comparisons between districts, creating the illusion that some schools are better funded than they truly are.

The Broader Implications for School Budgets

The inclusion of pass-through funds in school budgets raises several concerns:

- Transparency: Parents, educators, and policymakers may struggle to understand how funds are actually being used.

- Equity: Districts with higher pass-through funding might appear wealthier, affecting how new funds are allocated.

- Policy Decisions: Misleading data can result in misguided policy decisions at the state or federal level.

In addition, inflated per-student spending figures can erode public trust, as stakeholders may believe that schools are mismanaging their finances when, in reality, the issue lies in how budgets are reported.

Improving Transparency in Education Financing

To address these challenges, several steps can be taken:

- Separate Accounting: Districts can report pass-through funds separately from general operating budgets to provide a clearer picture of discretionary spending.

- Standardized Metrics: State and federal agencies should develop standardized methods for calculating per-student spending that account for pass-through funds.

- Stakeholder Education: Educating the public about how pass-through funds work can help manage expectations and build trust in the budgeting process.

By adopting these practices, school districts can ensure that funding data accurately represents the resources available to students and teachers.

In conclusion, pass-through funds play an essential role in supporting specific educational programs, but their inclusion in per-student spending calculations can distort the true picture of school financing. Transparent and standardized accounting practices are crucial for ensuring equitable resource allocation and maintaining public trust in the education system.

Readability guidance: This article uses short paragraphs, clear subheadings, and lists to ensure readability. It minimizes passive voice and long sentences, making it accessible while maintaining a professional tone.