Pass-through funds, per-student spending, and school budgets are three critical components in the financial evaluation of K12 school districts. However, the way pass-through funds are reported within school financial statements can obscure the real picture of resource allocation. Using the rising costs of school transportation as an example, this article delves into how these funds impact the accuracy of per-student spending metrics and why this should matter to educators, policymakers, and taxpayers.

Understanding Pass-Through Funds in School Budgets

Pass-through funds are financial resources that flow through one entity (such as a state government) to another (like a school district) without being considered direct revenue for the receiving entity. These funds are earmarked for specific purposes, such as transportation, special education, or federal meal programs. While they provide essential support, their inclusion in per-student spending figures can create a misleading narrative.

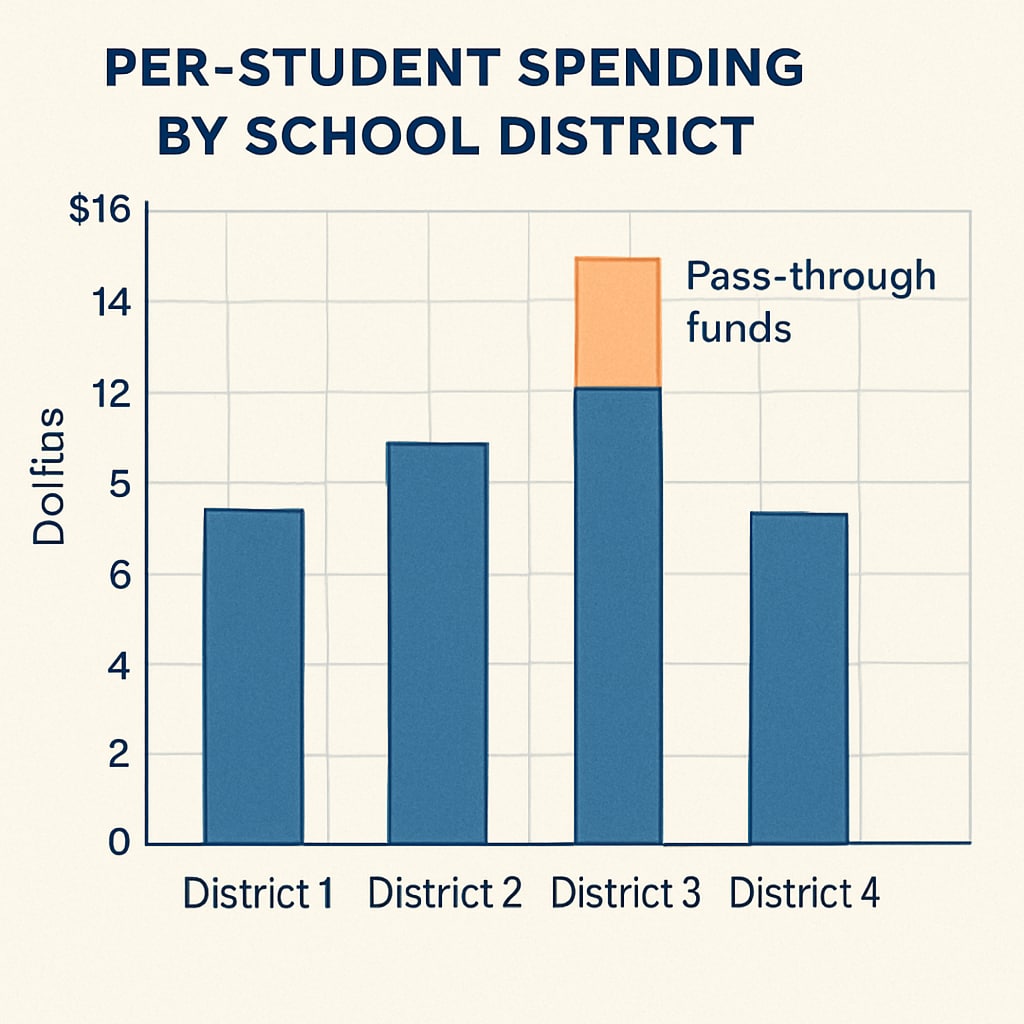

For example, if a state allocates additional funds to cover rising school bus operation costs—driven by fuel increases or new safety regulations—districts may report these as part of their overall spending. This can inflate the perceived investment in education resources, even though the funds are restricted to non-instructional activities.

How Per-Student Spending Metrics Are Affected

Per-student spending is a standard measure used to evaluate the financial commitment to education. It is calculated by dividing total expenditures by the number of enrolled students. However, when pass-through funds are included, they can distort this metric. Here’s how:

- Inflated Spending Figures: By including funds allocated for non-instructional purposes, the reported per-student spending may appear higher than it actually is for classroom-related activities.

- Misleading Comparisons: Districts with significant pass-through funding may seem better funded compared to those that rely more on local revenue, even if the instructional spending is similar.

- Skewed Policy Decisions: Policymakers relying on inflated figures may allocate resources based on misleading data, potentially neglecting underfunded areas.

For instance, a district receiving substantial state aid for transportation may report higher per-student spending than a neighboring district. However, this does not necessarily mean the former is investing more in classroom resources like teacher salaries, textbooks, or technology.

Implications for Resource Allocation and Transparency

The inclusion of pass-through funds in spending metrics raises critical questions about transparency and equity in school funding. Policymakers and stakeholders need to consider the following implications:

- Transparency: Clear reporting practices are necessary to distinguish between restricted and unrestricted funds. This differentiation allows stakeholders to understand how resources are allocated.

- Equity: Pass-through funds can mask disparities between districts. Wealthier districts may appear less advantaged due to lower state aid, despite having more local revenue.

- Policy Effectiveness: Accurate data is essential for evaluating the effectiveness of funding policies and ensuring resources reach those most in need.

To address these concerns, some states and districts are adopting more detailed financial reporting practices. For example, separating pass-through funds from operational budgets can provide a clearer picture of true educational investment per student.

Conclusion: The Need for Accurate Metrics

Pass-through funds play a vital role in supporting essential services like transportation and meal programs. However, their inclusion in per-student spending metrics can lead to inaccurate assessments of school district budgets. By improving transparency and separating restricted funds from general budgets, stakeholders can make more informed decisions to ensure equitable resource allocation. As education funding continues to evolve, understanding the nuances of these financial mechanisms is crucial for fostering a fair and effective system.

As a result, educators, policymakers, and taxpayers must push for greater clarity in school financial reporting. Only through accurate metrics can we ensure that every dollar serves its intended purpose: enhancing the quality of education for all students.

Readability guidance: This article uses concise paragraphs, clear subheadings, and lists to improve readability. Overuse of passive voice and long sentences has been minimized, while transitions like “for example,” “as a result,” and “however” are used to maintain flow.