Federal student loans, SAVE plan modifications, and unexpected payment increases have created a financial crisis for nearly 8 million borrowers, with K12 educators disproportionately affected. The U.S. Department of Education’s recent policy shift recalculates income-driven repayment (IDR) formulas, causing monthly obligations to surge by 20-300% for some public service workers.

How SAVE Plan Restructuring Impacts Educators

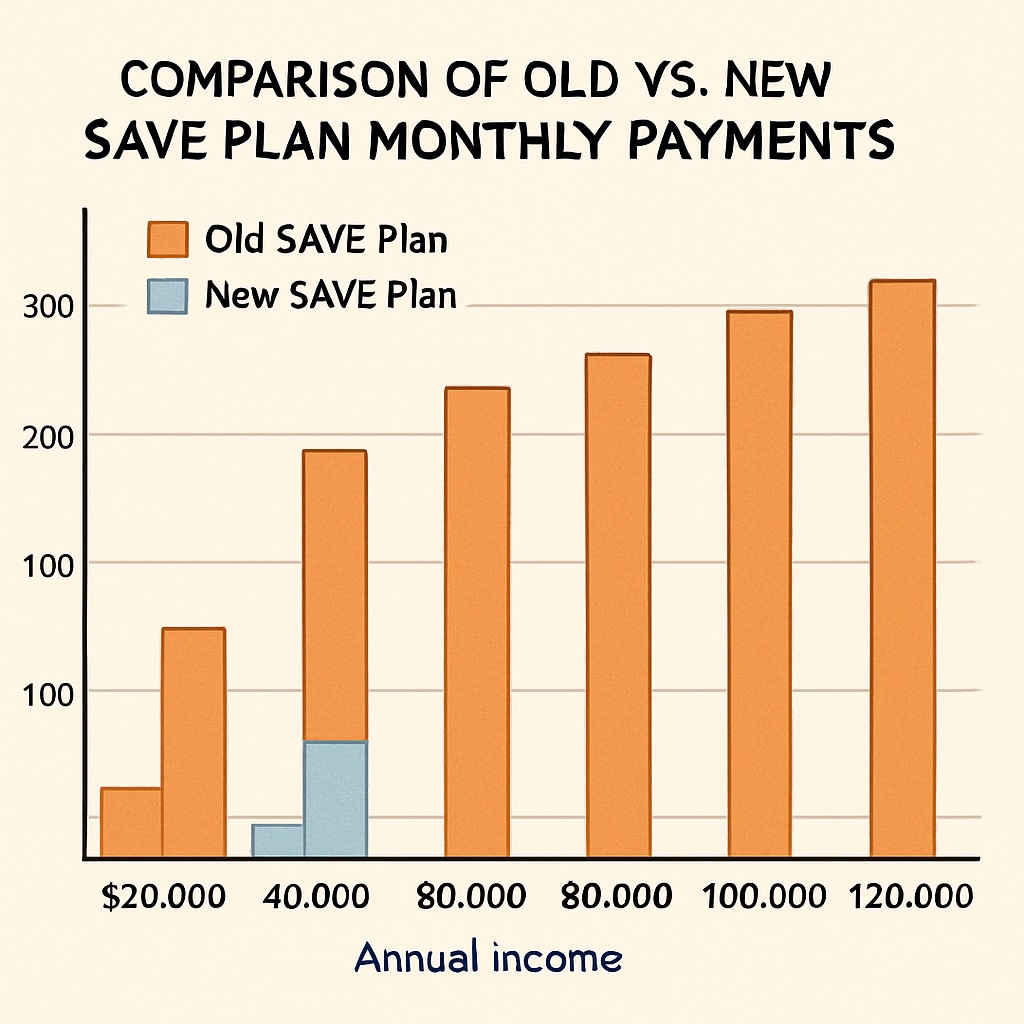

The revised Saving on a Valuable Education (SAVE) plan—originally designed to lower payments—now uses stricter income calculations. Key changes include:

- Counting spousal income regardless of tax filing status (previously excluded for separate filers)

- Removing the 150% poverty guideline buffer for discretionary income

- Accelerating the repayment timeline from 20 to 15 years for balances under $12,000

According to Brookings Institution research, these adjustments particularly harm teachers earning modest salaries in high-cost areas.

Financial Survival Strategies for Affected Borrowers

Educators facing payment shocks should consider these steps:

- Recertify income early: Submit updated tax documents if your income decreased (Federal Student Aid guidelines)

- Explore Public Service Loan Forgiveness (PSLF): 120 qualifying payments can eliminate remaining debt

- Request economic hardship deferments: Temporarily pause payments if eligible

While the Department of Education claims these changes “improve long-term plan sustainability,” the National Education Association reports 63% of teachers already work second jobs to cover expenses. As student loans, SAVE plan terms, and payment increases collide, financial literacy becomes essential for educational professionals.