The recent changes to the SAVE (Saving on a Valuable Education) student loan repayment plan have left nearly 8 million borrowers, including thousands of K12 educators, facing sudden payment increases. As the federal government eliminates most income-adjusted repayment options, teachers and public service workers must now navigate significantly higher monthly obligations.

How the SAVE Plan Restructuring Impacts Educators

Previously, the SAVE plan allowed borrowers to:

- Make payments based on discretionary income

- Receive forgiveness after 10 years of public service

- Have unpaid interest waived under certain conditions

However, according to the Federal Student Aid website, these benefits are now being scaled back. For example, a teacher earning $45,000 annually could see payments jump from $120 to over $300 per month.

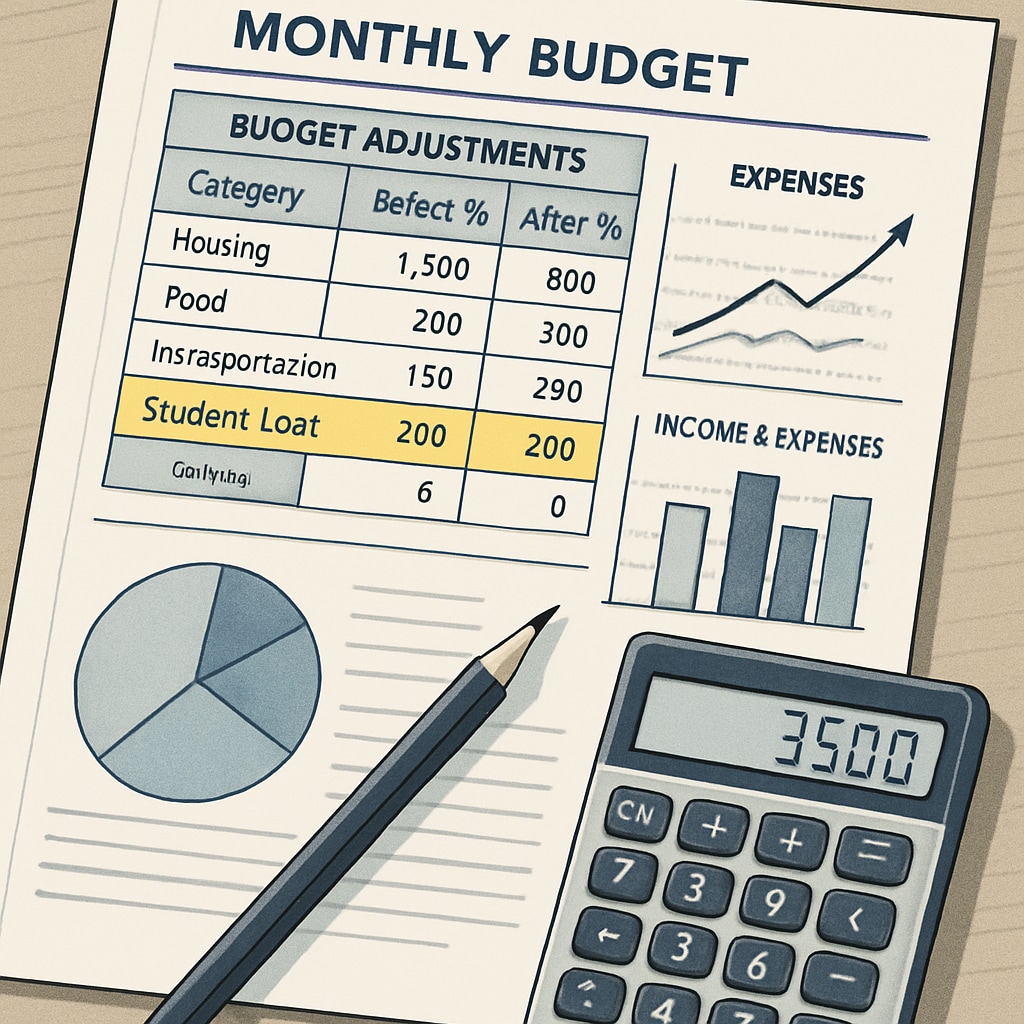

Financial Strategies for Affected Borrowers

Education professionals can take these steps to manage the repayment increase:

- Re-evaluate budget priorities using tools from Consumer Financial Protection Bureau

- Explore alternative repayment plans like Income-Driven Repayment (IDR)

- Investigate Public Service Loan Forgiveness (PSLF) qualifications

School districts and teachers’ unions are urging affected educators to act quickly. “We’re seeing members panic about these changes,” notes National Education Association financial advisor Mark Williams. “Early planning is crucial to avoid default.”

Transition tip: Therefore, educators should schedule a consultation with their loan servicer immediately. Meanwhile, advocacy groups continue pushing for legislative solutions to this growing financial crisis.