Recent federal student loan policy changes under the SAVE plan have sparked concerns among borrowers. Nearly 8 million individuals, including K-12 educators, are at risk of facing higher monthly payments, which could significantly impact their financial stability. These changes are particularly concerning for families in areas such as Kansas City, where borrowers may see hundreds of dollars added to their monthly bills.

What Is the SAVE Plan?

The SAVE plan, short for “Saving on a Valuable Education,” is part of an income-driven repayment (IDR) scheme aimed at reducing financial burdens for federal student loan borrowers. It calculates monthly payments based on discretionary income, offering relief to low-income earners. However, recent changes to the policy have altered how payments are calculated, potentially raising monthly obligations for many borrowers.

For example, borrowers who previously benefited from reduced payments under older policies may now find themselves paying more due to adjusted income thresholds or changes to interest accumulation rules. This shift has raised alarms, particularly for educators and public-sector workers who rely heavily on income-driven repayment plans.

How Are Borrowers Impacted?

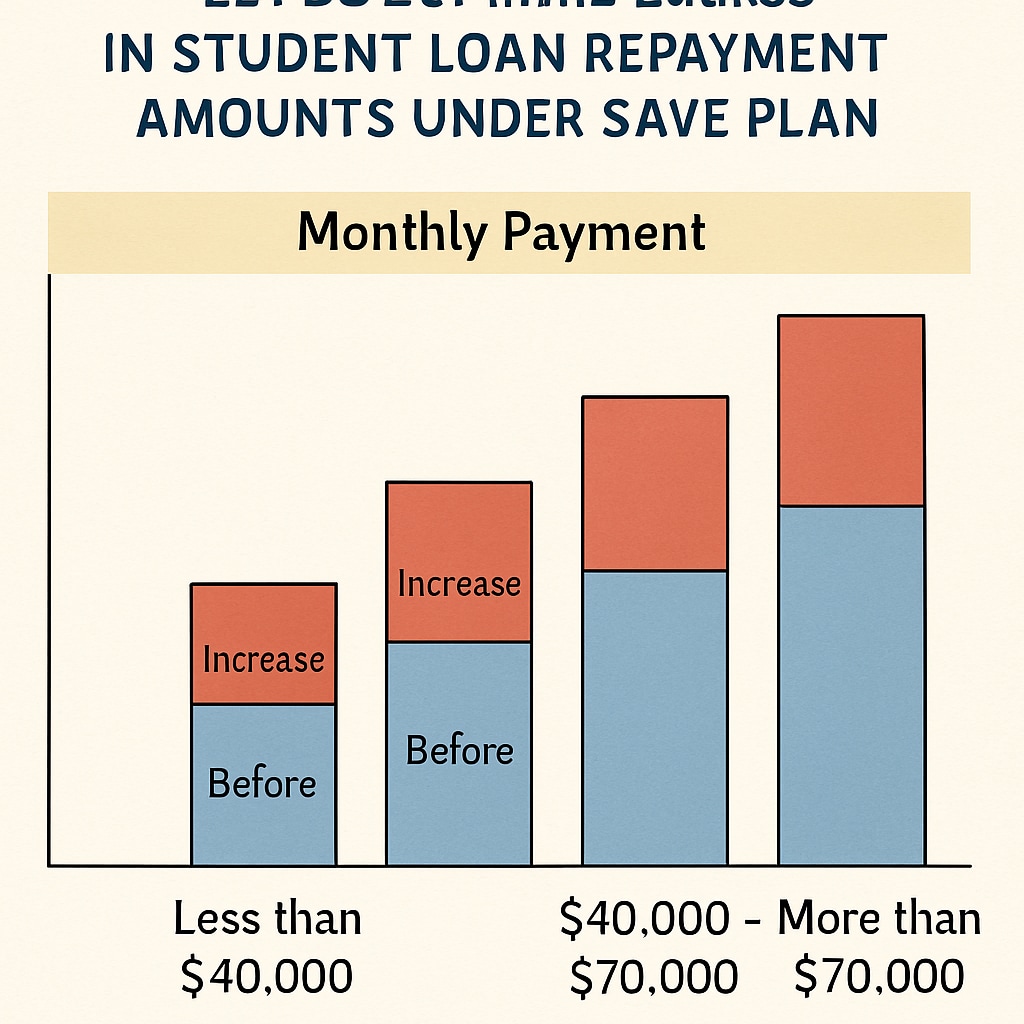

According to the Department of Education, the new SAVE plan adjustments may increase monthly loan payments by hundreds of dollars for some borrowers. This is particularly troubling for those working in K-12 education, where salaries often lag behind other professions. For families in regions like Kansas City, where cost-of-living expenses are already high, the added financial stress could lead to budgetary crises.

- Higher Monthly Payments: Borrowers may see a significant increase in their monthly obligations, depending on their income and family size.

- Reduced Discretionary Income: Higher payments mean less money available for essential expenses like housing, food, and childcare.

- Long-Term Impact: Increased repayment amounts may lead to prolonged financial strain, affecting savings and retirement plans.

Who Will Feel the Effects Most?

The SAVE plan changes disproportionately affect borrowers in middle-income brackets who previously benefited from minimized monthly payments. Educators, especially in public school systems, are among the groups most likely to feel the effects. Many of these professionals already struggle with modest salaries, and the added financial strain could affect their ability to support their families and invest in their futures.

In addition, the changes may discourage younger generations from pursuing careers in education or other public-service fields that require advanced degrees but offer relatively low compensation.

What Can Borrowers Do?

While the SAVE plan adjustments are mandatory for federal student loans, borrowers can take steps to mitigate their financial impact:

- Review Loan Terms: Stay informed about policy updates and how they affect repayment calculations.

- Explore Forgiveness Programs: Public Service Loan Forgiveness (PSLF) and other options may offer relief for educators and public-sector workers.

- Budgeting: Reassess monthly budgets to account for higher loan payments and identify areas to reduce discretionary spending.

- Seek Financial Counseling: Professional advice can help borrowers create strategies to manage increased repayments effectively.

Conclusion

As federal policies evolve, borrowers must remain vigilant about the financial implications of programs like the SAVE plan. While designed to provide relief, recent changes may inadvertently lead to higher monthly payments for millions of individuals, particularly those working in K-12 education. By staying informed and proactive, borrowers can work to mitigate the impact and protect their financial stability.

Readability guidance: Short paragraphs and structured lists are used to summarize key points. Overuse of long sentences and passive voice is avoided for clarity and brevity. Transition words like “however,” “therefore,” and “for example” are evenly distributed to improve flow.