The sudden changes in the federal student loan SAVE plan are triggering a significant increase in monthly repayments for nearly 8 million borrowers. This situation is having a profound impact on K12 teachers and students’ families, reshaping the educational landscape in the United States.

The SAVE Plan Shift

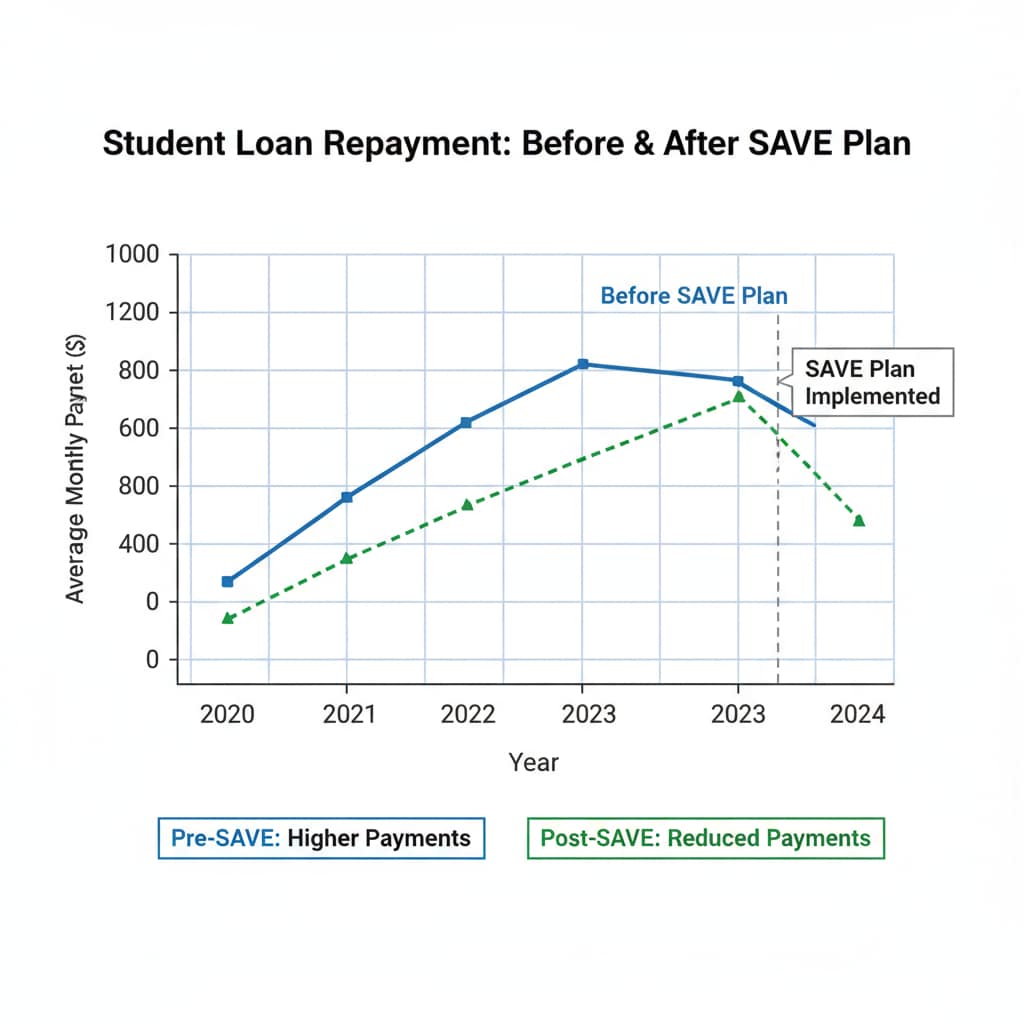

The SAVE (Savings on a Valuable Education) plan was initially designed to provide relief to student loan borrowers. However, the recent alterations have led to unexpected consequences. For example, borrowers who were previously on a more manageable repayment schedule are now facing a substantial hike in their monthly payments. According to Consumer Financial Protection Bureau, these changes are not only affecting individual borrowers but also have a broader impact on the economy.

Impact on K12 Teachers

K12 teachers play a crucial role in the education system. However, the increased student loan repayments are putting a strain on their finances. Many teachers are already on relatively modest salaries, and the sudden jump in loan payments means they have to make difficult financial decisions. Some may have to cut back on professional development opportunities, which could ultimately affect the quality of education they provide. As a result, it becomes a cycle that impacts both the teachers and their students.

Consequences for Student Families

Student families are also feeling the pinch. With parents already juggling multiple financial responsibilities, the rise in student loan repayments adds another burden. This could lead to a reduction in the amount of money available for a child’s education-related expenses, such as extracurricular activities or tutoring. Moreover, it might even influence decisions about higher education, as families become more cautious about taking on additional debt.

Readability guidance: The key points here are the unexpected changes in the SAVE plan, its negative impact on K12 teachers’ finances, and the consequences for student families. These changes are creating a challenging situation for both groups, highlighting the need for a more balanced approach to student loan policies.