For many students, the path to higher education is fraught with financial challenges. Tuition difficulties, crowdfunding platforms like GoFundMe, and the pursuit of demanding fields such as medical school reveal significant gaps in how the K12 education system prepares students for the financial realities of college. Without proper financial literacy education or equitable access to funding, students are often forced to rely on unconventional methods to cover their expenses, raising critical questions about the future of educational equity.

Why Financial Planning Is Lacking in K12 Education

The K12 education system focuses heavily on academic preparedness, but often overlooks the importance of financial literacy and planning. As a result, students graduate high school with little knowledge about tuition costs, student loans, or scholarships. According to Britannica, financial literacy is considered essential for navigating modern life, yet it remains absent in many school curriculums.

Without early exposure to these topics, students are left unprepared to make informed decisions about funding their education. This gap becomes especially pronounced for students pursuing costly degrees, such as those in medicine, where tuition and fees can exceed $100,000.

Crowdfunding as a Lifeline for Struggling Students

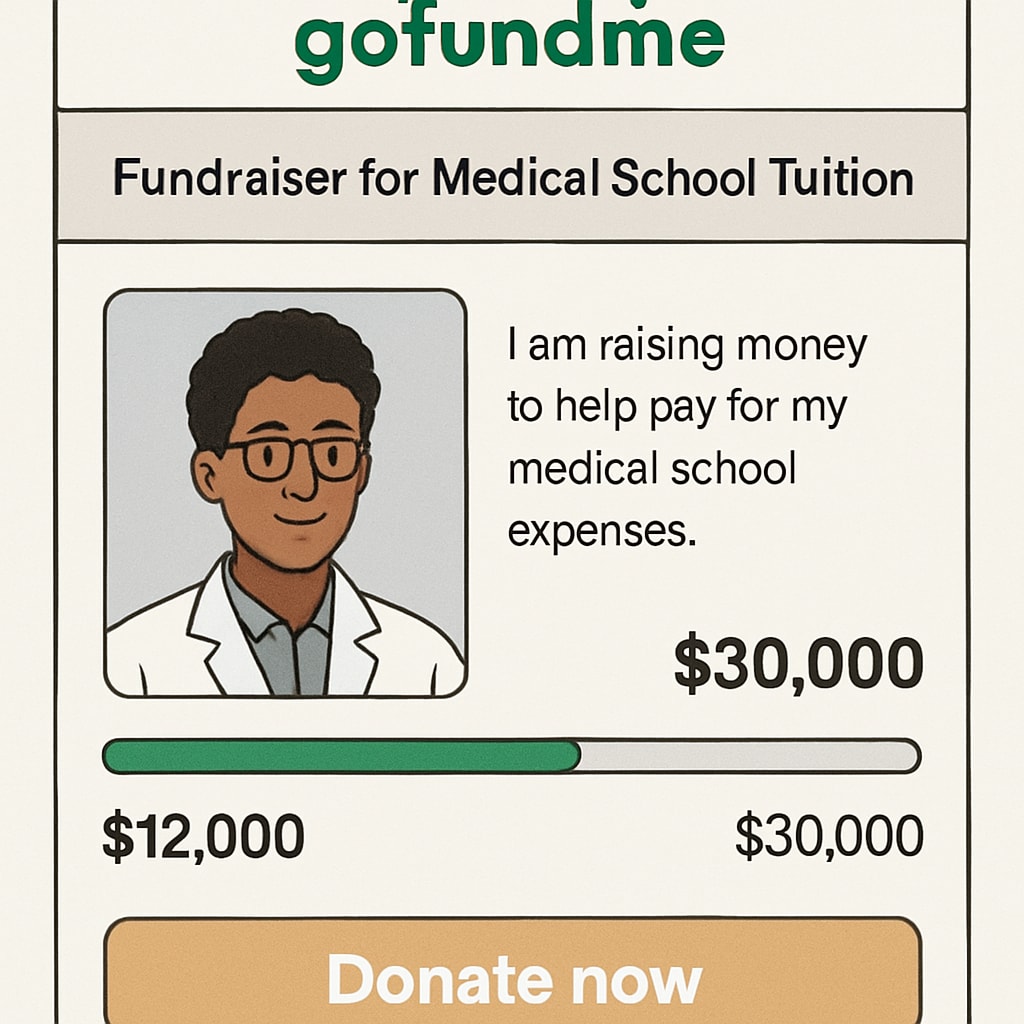

In the absence of sufficient financial aid or savings, many students turn to crowdfunding platforms like GoFundMe. These platforms allow students to share their stories and seek donations to cover tuition costs. For aspiring medical students, whose educational journeys are particularly expensive, crowdfunding often serves as a vital resource.

While crowdfunding can be effective, it is not an ideal solution. It places the burden of educational funding on the individual rather than addressing systemic inequities in the education system. Furthermore, reliance on crowdfunding underscores the urgent need for reform in how educational institutions and governments support students financially.

Solutions for Closing the Gap

To address the issue of tuition challenges and reliance on crowdfunding, several steps can be taken:

- Integrate Financial Literacy in K12 Curricula: Schools should teach students about budgeting, loans, and scholarships starting in middle or high school.

- Expand Access to Scholarships: Governments and institutions should increase funding for merit- and need-based scholarships to reduce financial barriers.

- Build Community Support Programs: Local organizations and alumni networks can provide mentorship and financial support to students pursuing higher education.

These reforms would not only reduce reliance on platforms like GoFundMe but also empower students to make informed decisions about their educational futures. For example, Wikipedia notes that scholarships are a proven method of improving access to education for underprivileged students.

Conclusion: Paving a Sustainable Path Forward

As crowdfunding becomes increasingly common among students, it highlights the urgent need for systemic change. Tuition challenges, platforms like GoFundMe, and the pursuit of medical school dreams are symptoms of larger issues in how society supports education. By reforming K12 curricula to include financial literacy, expanding access to scholarships, and fostering community support, we can create a more equitable system that allows all students to achieve their academic goals without facing insurmountable financial obstacles.

Ultimately, investing in these solutions will ensure that students no longer have to rely on crowdfunding to make their education dreams a reality. Instead, they will be equipped to navigate the financial demands of higher education with confidence and resilience.