For many K12 graduates, the pursuit of a bachelor’s degree can be derailed by financial difficulties and academic setbacks. University credits, which are crucial for obtaining a degree, can become a source of stress when combined with debt issues. This article delves into the various ways students can salvage their academic dreams and earn their much-deserved bachelor’s degree.

Understanding the Credit Transfer Process

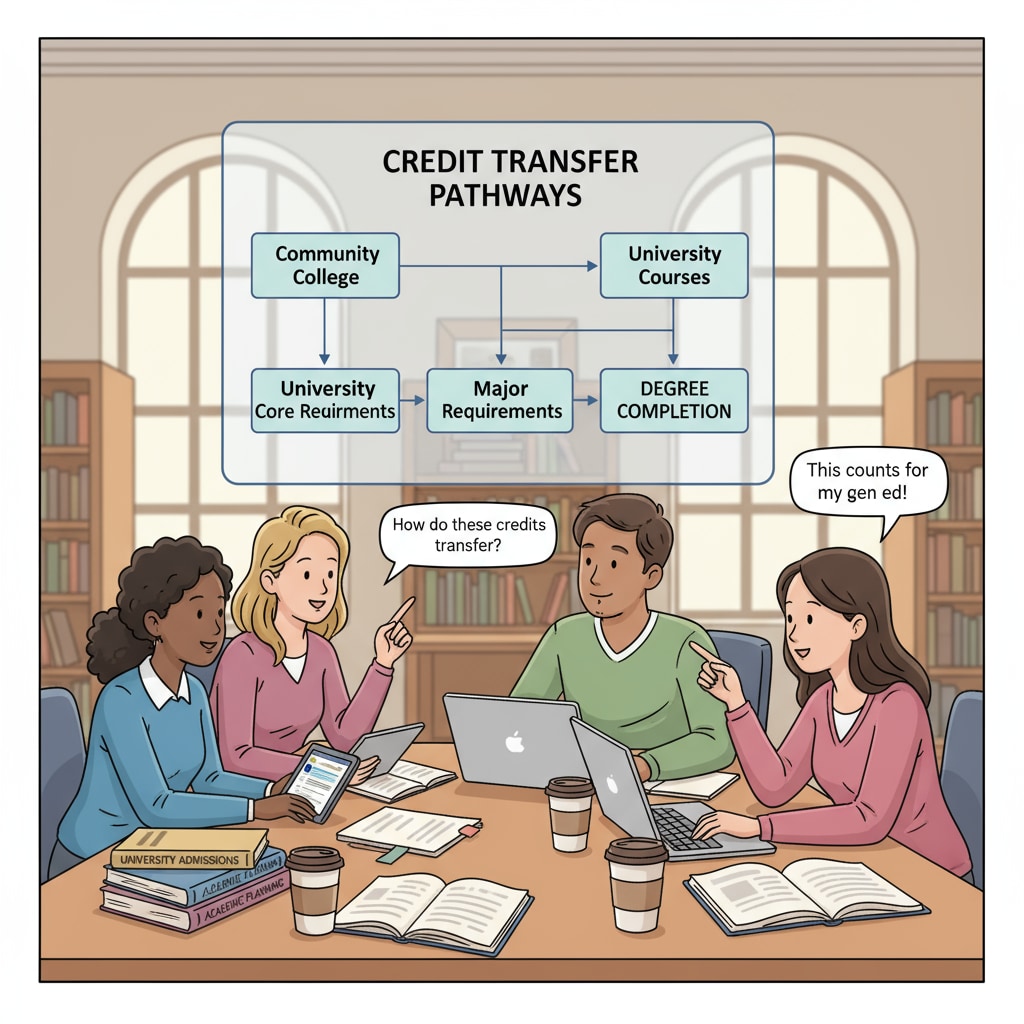

Credit transfer is a valuable option for students looking to complete their bachelor’s degree. It allows them to move credits earned at one institution to another. However, it’s essential to understand the rules and requirements of the receiving institution. For example, some universities may have specific criteria for the types of courses they accept as transfer credits. According to Britannica, the credit transfer process can vary widely from one school to another. Some might require a minimum grade point average in the transferred courses, while others may limit the number of credits that can be transferred.

Alternative Courses and Their Role

In addition to traditional courses, alternative courses can play a significant role in obtaining a bachelor’s degree. Online courses, for instance, offer flexibility and often more affordable options. They can be a great way to earn the necessary credits without the high costs associated with on-campus learning. Many reputable institutions now offer a wide range of online courses that are recognized for credit. As a result, students facing financial constraints can explore these alternatives. Wikipedia provides detailed information on the growth and acceptance of online education in the context of degree completion.

Another aspect to consider is the availability of community college courses. Community colleges often offer lower-cost courses that can be transferred to four-year universities. This provides an opportunity for students to save money while still working towards their bachelor’s degree. Moreover, community colleges may have more flexible admission requirements, making it easier for students who have faced academic challenges to get back on track.

Financial aid is also a crucial factor in overcoming the obstacles related to university credits, bachelor’s degree, and debt issues. There are various forms of financial aid available, such as scholarships, grants, and loans. Scholarships and grants are ideal as they do not require repayment. Students should actively search for scholarships that are relevant to their field of study or personal circumstances. Loans, on the other hand, should be carefully considered due to the repayment obligations. However, they can be a necessary option for some students to complete their education.

Readability guidance: By understanding the credit transfer process, exploring alternative courses, and leveraging financial aid, students can increase their chances of successfully obtaining a bachelor’s degree despite financial difficulties and debt issues. It’s important to take proactive steps and seek out the resources available to turn your academic dreams into reality.